-

Teruo KawashimaDirector and Managing Executive Officer

In charge of Chief Executive of Finance and Accounting Division - Since joining the Company, Teruo Kawashima worked for many years in the Finance and Accounting Department, where he formulated and executed financial strategies. With the Company’s reorganization in April 2020, he was appointed as the executive officer in charge of the new Finance and Accounting Division. Since UACJ’s establishment in 2013, Mr. Kawashima has been responsible for international business strategies, international investment planning, investor relations, and relations with capital market players. He worked in Chicago, USA, from 2016 to 2019.

Committed to structural reforms for increasing earnings capacity and improving the financial structure

From fiscal 2018, ended March 31 2019, the UACJ Group had been postponing reforms of its financial structure while continuing to post financial results below targets. The failure to achieve those targets was mainly attributable to the impact of market trends, including the trade war between the United States and China, the slowdown of China’s economy, and, in fiscal 2018, a steep drop in demand for aluminum materials and components used in IT-related devices and thick plates used in liquid crystal and semiconductor manufacturing equipment. Due to these sudden changes in the market, results posted by the Group’s core businesses—its main revenue base—worsened significantly at a time when they should have been generating substantial returns on large growth investments, which had been carried out in the United States and Thailand for the purpose of expanding the businesses over the medium and long terms.

Regrettably, the Group’s business structure was not able to adapt to those changes in the market, and our management organizations encountered serious issues. In response, we initiated a set of structural reforms in October 2019, primarily aimed at increasing earnings capacity, reforming the financial structure, and increasing the speed and efficiency of management decision-making.

Since the Company’s establishment in 2013, the UACJ Group has grown into one of the world’s top three aluminum product manufacturers, and accounts for over half of all flat-rolled aluminum manufactured in Japan. It employees almost 10,000 people worldwide and deals with a large number of customers, suppliers, and business partners in the global market. This means we have a much bigger social responsibility than ever before. Therefore, to fulfill our responsibility, we must carry out the structural reforms with an unwavering commitment.

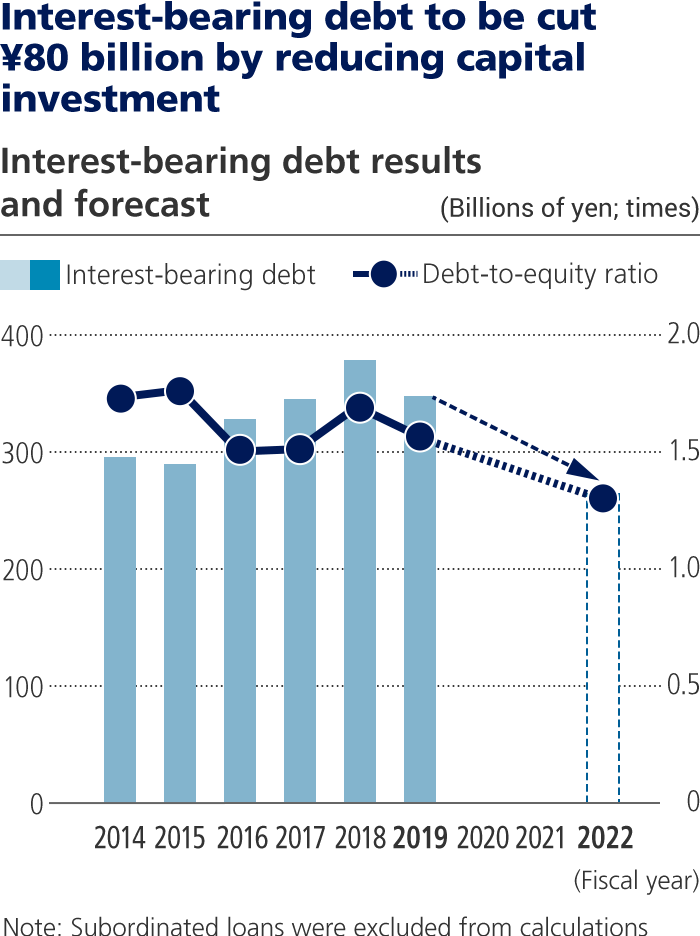

As chief financial and accounting officer, I am determined to lead the Company’s efforts to reform its financial structure. Specifically, I will push ahead with reducing total assets and interest-bearing debt while aiming to maintain positive free cash flow with strict financial discipline. Unfortunately, to respond to the outbreak of COVID-19, we had to temporarily diverge from our policy of improving the financial structure and borrow an additional ¥30 billion. We also established committed credit lines totaling ¥43 billion with financial institutions in order to maintain stable operations amid the ongoing economic disruptions caused by the pandemic.

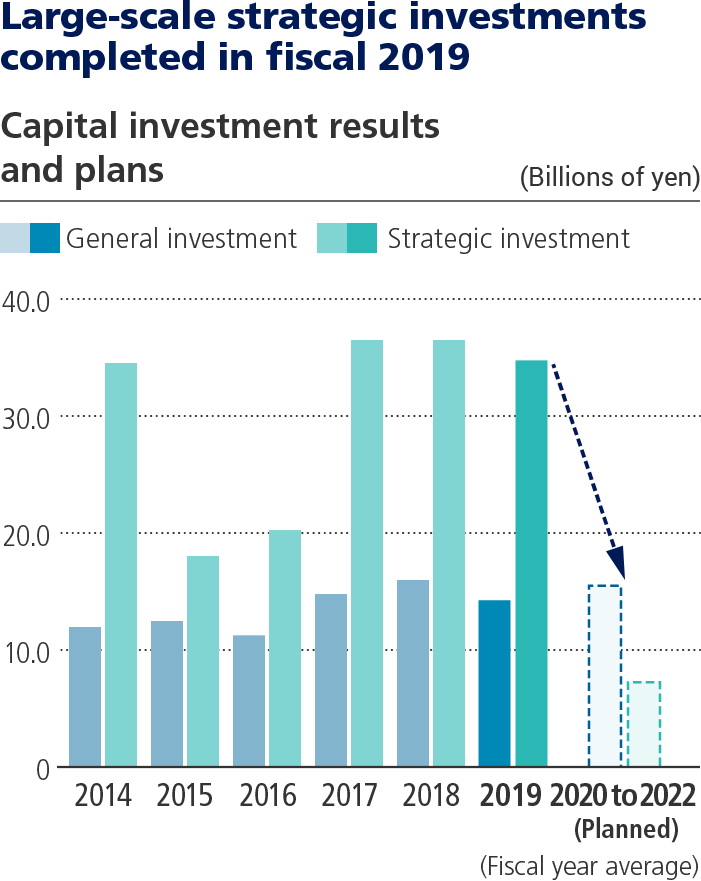

While taking these steps to secure credit, we largely completed large-scale investment projects for UACJ (Thailand) Co., Ltd., and Tri-Arrows Aluminum Inc., and proceeded to restrict capital investment in order to manage cash flow and deal with the difficult business conditions brought on by COVID-19. In fiscal 2020, we are limiting capital investment to an amount commensurate with depreciation and amortization, and expect it to total about half the level of fiscal 2019.

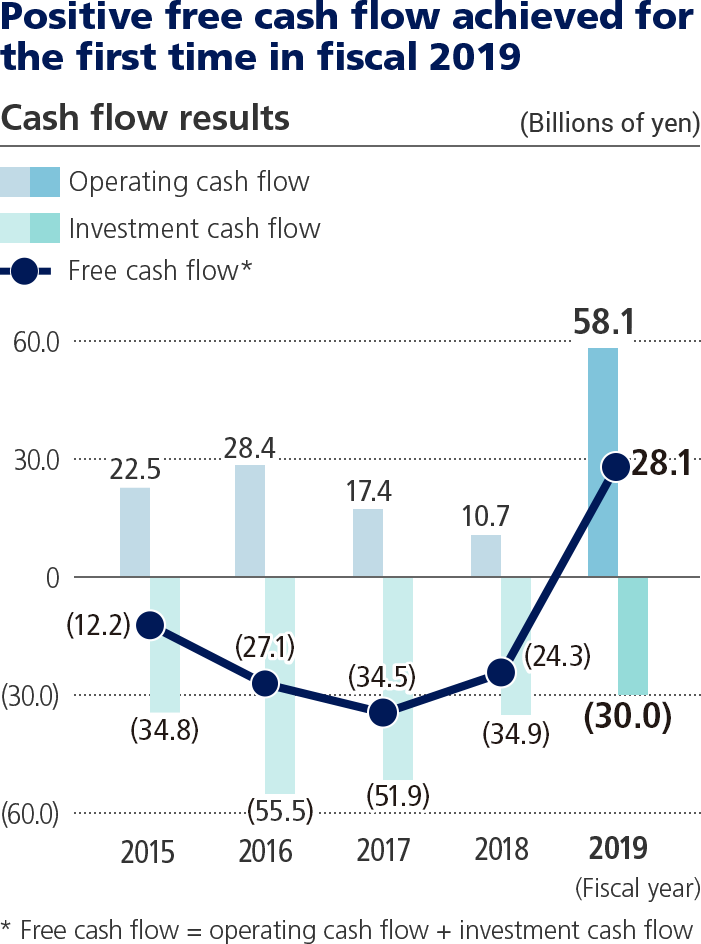

Through our latest structural reform plan, we are working to improve profitability by ¥21 billion by fiscal 2022 and reduce interest-bearing debt by ¥80 billion over the next three years. We have rationalized production in Japan, and large-scale investments in Thailand and the U.S. have begun generating steady returns. In fiscal 2019, the Company achieved positive free cash flow for the first time since it was established and improved its financial structure to some extent. Looking ahead, maintaining strict financial discipline will be essential for realizing the objectives of our structural reforms. Therefore, while making sure to allocate resources to growth businesses, we will continue taking all necessary steps to improve the financial structure and bring the debt-to-equity ratio down to 1.3 during the period of our structural reform plan. Eventually, we will aim to reduce the ratio to 1.0, which we regard as an indicator of financial soundness.

Progress in reforming the financial structure

Managing businesses from the perspective of capital efficiency

Along with improving and restoring the soundness of the financial structure, another objective of our structural reform plan is to strengthen financial management, which will be needed to ensure the medium- and long-term

growth of the entire UACJ Group. Accordingly, we revamped our management practices and introduced a number of key performance indicators (KPIs) tailored to our places of business.

The Company’s finance departments work to boost profitability, capital efficiency, and financial management by using various financial indicators, including return on equity (ROE), return on invested capital (ROIC), and the debt-to-equity (D/E) ratio. I believe there should be no divergence between such indicators and the management tools used at production plants and sales offices. In the past, practically all of our workplaces had been managed on the basis of profit and loss accounting. In the future, however, they will need to incorporate asset efficiency and cash flow management into their management practices because paths taken by the Company’s businesses to attain targets had differed from that of its finance departments.

I will illustrate this with an example. Our production plants keep a certain amount of inventory to ensure that they can dependably manufacture and supply products. Plants that manufacture flat-rolled aluminum need more than two months of lead time after aluminum ingots are melted in order to carry out numerous production processes until a product is finished and ready for shipment. Therefore, they must keep enough aluminum in stock for each production process so that products can be shipped on schedule, even if a problem arises during one of those processes. Funds for ordering aluminum ingots, all of which must be imported because they are not made in Japan, are provided in advance based on purchase plans. From a financial perspective, reducing these inventory assets helps us reduce total assets, raise asset efficiency, and maximize cash flow, thereby improving ROE, ROIC, and the D/E ratio. In contrast, increasing or decreasing these inventory assets has no direct effect if only profits and losses are considered in managerial accounting.

The balance sheet and cash flow must be integrated in the accounting practices of our operational management, and I will lead efforts to widely adopt this approach going forward. To ensure that, it will be necessary to put systems in place that demonstrate what our businesses can do to improve financial performance. We are moving forward with our KPI program to show how various initiatives currently being carried out to improve operations are related to financial results. The deployment of KPIs is very helpful for analyzing why businesses have failed to meet targets or beat targets. All of the Group’s manufacturing plants have been managing their operations from the perspective of profit and loss accounting for many years, so adopting a different approach is not an easy matter. Nevertheless, I have been discussing this with the heads of each business division, and expect our new management method to be fully adopted within the next three years as a framework for managing the divisions.

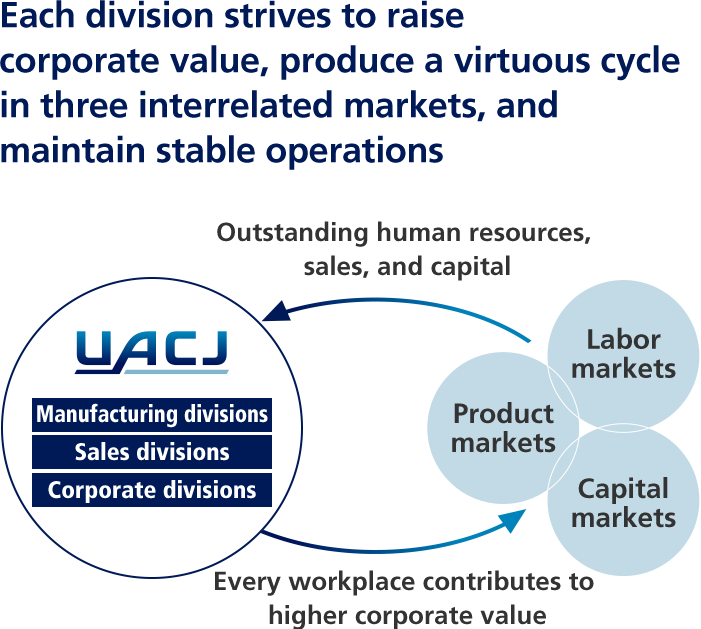

To ensure that our operations are reformed in this way, I will continue engaging in discussions with the heads of each business division in my role as chief financial and accounting officer. To have personnel at various workplaces recognize the importance of our financial affairs, when explaining our operational management, I have recently begun discussing three markets that companies deal with. It goes without saying that our workplaces are keenly aware of the product market, where profits are made from the sale of goods. Besides the product market, however, a company must deal with capital markets to secure the funds it needs to conduct business, and with the labor market to attract people who can run its businesses. All three of these markets are necessary for a company to continue operating.

By taking that perspective, employees will come to understand that it is not enough for a company to be profitable. We procure the funds needed to operate our businesses from capital markets, so we should use the weighted average cost of capital as a profit target because it includes the cost of debt and the cost of capital. Corporate value will not go higher unless those targets are attained. By increasing corporate value, the Company can earn a higher credit rating, raise its presence in the product market, and more effectively attract the best talent from the labor market. By securing skilled human resources and leveraging that presence to boost sales, we can return more profits to employees and shareholders, and more easily procure the funds we need to operate from capital markets. By explaining how the three markets are interrelated in these ways, I want management to understand how measures executed by each business are linked to our financial indicators, and how that contributes to increasing corporate value.

We must also take on another major challenge from now: adapting our financial management to the globalization of the Group’s businesses. When UACJ was established through the merger of its founding companies in 2013, sales outside Japan accounted for about 30% of total net sales, but they are now almost half. Likewise, sales volume of flat-rolled aluminum to foreign markets now exceeds the amount to the domestic market. The investment funds needed for expanding capacity of the Group’s production plants in the U.S. and Thailand have been procured in Japan up to now, but as their operations reach capacity and sales grow, cash flows in those countries will increase in the near future. Consequently, cash flow management by overseas subsidiaries will become much more important. Therefore, we are planning to set up a global cash flow management organization, which will not only oversee locally generated cash flows but also handle foreign currency management and national tax systems.

Approach to raising corporate value

Tapping demand in growing markets with environmentally friendlier products

While the UACJ Group is currently making concerted efforts to reform its financial structure and business management organizations, it is also focusing on returning profits to shareholders in the future in anticipation of substantial returns on past investments. Along with paying dividends, increasing corporate value should also be considered as a means to return profits to shareholders. Based on both of those means, we are planning to set a target for total shareholder return and implement measures to achieve it.

Today, economic conditions are very challenging due to various factors, including the ongoing worldwide COVID-19 pandemic and the trade war between the United States and China. Taking a broader view from a medium- to long-term perspective, however, aluminum product manufacturers appear to be ideally positioned for raising value in the future. With the increasing seriousness of climate change and environmental problems worldwide, we can expect demand for aluminum products that offer solutions to continue rising.

One such product is flat-rolled aluminum for can stock, the UACJ Group’s mainstay product. In recent years, ocean plastic pollution has been extensively covered by the mass media, which has led to worldwide efforts to use alternatives to plastic as a material for beverage and detergent containers. Aluminum has attracted attention due to its excellent recyclability and relatively small burden on the environment. Aluminum auto parts are another type of product that contributes to environmental solutions. They are essential for reducing vehicle weight, which improves the mileage of gasoline powered cars and extends the distance traveled by electric vehicles. In the future, demand for aluminum body sheet and structural components for automobiles is projected to grow.

The UACJ Group can meet such market demand and respond to new applications for aluminum products in more and more regions of the world through its global supply network, which was established after UACJ’s establishment through substantial strategic investments in the United States and Thailand. Looking ahead, the Company will need to accelerate the returns from those investments to strengthen its financial base. Moreover, for the Group to increase its value over the medium and long terms, it must expand its businesses in those growing markets. To accomplish that, we intend to make necessary investments in R&D with a view to develop innovative manufacturing technologies and aluminum products that can attract new demand. Indeed, we regard R&D as the driver of higher corporate value in the future.

In tandem with the structural reforms initiated in 2019, we also revised our corporate philosophy. It expresses our aspiration to contribute to the prosperity and sustainability of society through our aluminum products businesses. All members of the UACJ Group can take great delight and pride in such contributions. As an essential enterprise for society, the UACJ Group will strive to meet the expectations of shareholders, customers, and all other stakeholders by increasing corporate and shareholder value in the years ahead.