Finances

Analysis of Business Performance and Financial Position (consolidated basis)

1. Business Performance

Business Environment

Influenced by a higher sales tax, UACJ experienced negative growth during the first half of fiscal 2014. However, signs of recovery began to appear in the second half, benefiting from various factors such as rising exports following recoveries in overseas markets and lower crude oil prices.

Amidst this environment, compared to the previous term, shipments of rolled aluminum products were up in categories including aluminum used for mainstay beverage cans, foil for condensers, and thick plate for liquid-crystal and semiconductor equipment. With exports also receiving a boost as the result of favorable exchange rates, overall shipments exceeded 2 million tons for the first time in four years. In the wrought copper sector, demand for use in commercial air-conditioners remained unchanged compared to the previous year. However, due to sluggish consumption stemming from the sales tax hike and the impact of unstable weather conditions, unit shipments of residential air-conditioners decreased 14% compared to the previous year.

Financial Results Overview

Under the aforementioned conditions, in March 2014, we announced the "UACJ Group Vision for the Future." Based on this vision, the Group is steadily introducing various measures aimed at realizing the effects of integration and pursuing global expansion with the aim of “becoming an aluminum industry leader in a competitive global market.”

In addition, in December 2014, we formulated “Global Step I,” the UACJ Group mid-term management plan. This plan explains the Group's vision for the future in specific areas of business; through which it will create robust revenue bases capable of withstanding changes in the business environment and achieve sustainable growth.

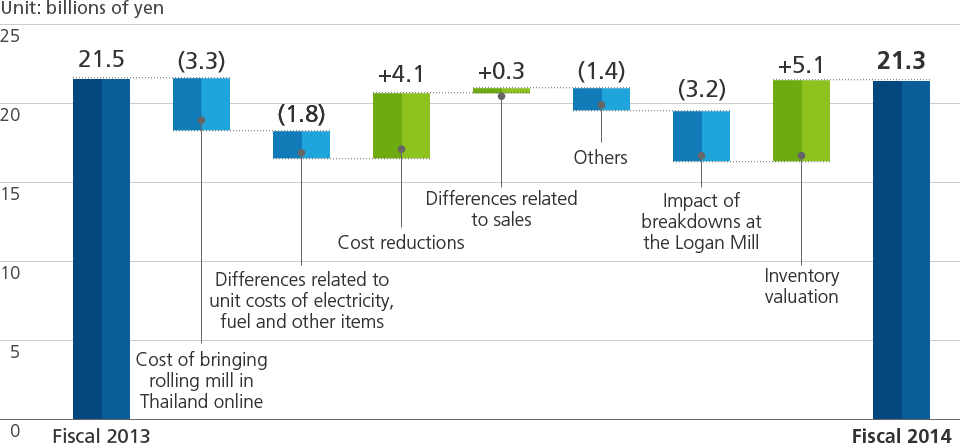

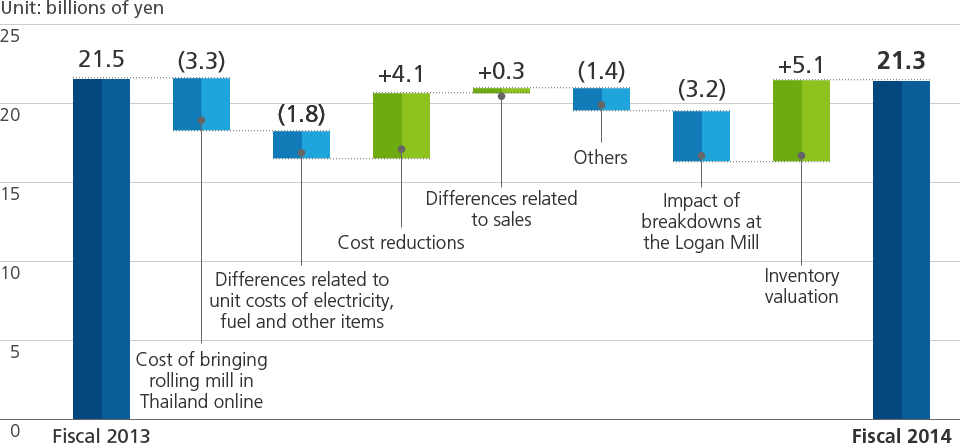

As a result, for fiscal 2014, the UACJ Group reported net sales of ¥572.5 billion (up ¥208.4 billion compared to the pervious term, and up ¥37.6 billion compared to the combined total of the two pre-merger companies for the same period). Operating income was ¥23.7 billion (up ¥5.9 billion compared to the previous term, but down ¥1.3 billion compared to the pre-merger combined total). Influenced by the expanding business scale following management integration, ordinary income was ¥21.3 billion (up ¥4.5 billion compared to the previous term, but down ¥0.2 billion compared to the pre-merger combined total), a substantial increase in the second-half compared to the previous term. Net income for the term ending March 31, 2015 was ¥8.6 billion (down ¥1.3 billion compared to the previous term, and down ¥3.1 billion compared to the pre-merger combined total). This result was largely attributable to the marginal gain of ¥6.1 billion declared in relation to the step acquisition of Tri-Arrows Aluminum Holding Inc. and Tri-Arrows Aluminum Inc. during management integration in the previous term.

* “Based on totals for the two former companies” in fiscal 2013 refers to the combined total for former Furukawa-Sky and former Sumitomo Light Metal Industries. (A simple reclassification has been made for TAAH, transforming from an equity-method affiliate to a consolidated subsidiary.) Fiscal 2014 (First-half combined total for the two former companies + Second-half for UACJ)

Rolled Aluminum Products

Segment performance was affected by an equipment breakdown at Logan Aluminum Inc., a manufacturing outsourcing partner of Tri-Arrows Aluminum Inc. However, demand grew for IT-related materials such as computer casings, the thick plate for liquid-crystal and semiconductor equipment, and the thick plate used in the construction of LNG tankers. In addition, the expanded scale of business resulting from management integration led to a substantial increase compared to the previous term. Accordingly, net sales of rolled aluminum products in fiscal 2014 totaled ¥451.9 billion (up ¥149.9 billion compared to the previous term) and operating income was ¥23.3 billion (up ¥5.7 billion for the same term).

Based on the pre-merger combined totals, net sales were up ¥31.8 billion and operating income was down ¥1.9 billion.

Wrought Copper Products

In fiscal 2014, demand for use in commercial air-conditioners remained unchanged compared to the previous year. However, due to sluggish consumption stemming from the sales tax hike and the impact of unstable weather conditions, unit shipments of residential air-conditioners decreased 14% compared to the previous fiscal year. As a result, net sales were ¥50.6 billion (up ¥26.5 billion compared to the previous term) and operating income was ¥1.0 billion (up ¥0.7 billion for the same term).

Based on pre-merger combined totals, net sales were up ¥2.7 billion and operating income was up ¥0.2 billion.

Precision-machined Components and Related Businesses

In fiscal 2014, performance in IT-related materials and automotive parts—mainly for North America—led to net sales of ¥161.6 billion (up ¥76.3 billion compared to the previous term). Operating income came to ¥4.6 billion (up ¥1.5 billion for the same term).

Based on pre-merger combined totals, net sales were up ¥13.8 billion and operating income was up ¥0.6 billion.

Segment Information/Net Sales

| Fiscal 2013 | Fiscal 2014 | Change | |

|---|---|---|---|

| Rolled aluminum products | 420.1 | 451.9 | 31.8 |

| Wrought copper products | 47.9 | 50.6 | 2.7 |

| Precision-machined components and related businesses | 147.8 | 161.6 | 138. |

| (Adjustment) | (80.9) | (91.6) | (10.7) |

| Total | 534.9 | 572.5 | 37.6 |

Segment Information/Operating Income

| Fiscal 2013 | Fiscal 2014 | Change | |

|---|---|---|---|

| Rolled aluminum products | 25.2 | 23.3 | (1.9) |

| Wrought copper products | 0.8 | 1 | 0.2 |

| Precision-machined components and related businesses | 4 | 4.6 | 0.6 |

| (Adjustment) | (5) | (5.2) | (0.2) |

| Total | 25 | 23.7 | (1.3) |

2. Forecast for the Next Term

Issues to Be Addressed

Even unclear, we believe the economic outlook in Japan points to ongoing economic recovery, but we expect the pace of recovery to be modest. Furthermore, we anticipate the domestic operating environment to remain difficult over the medium- to long-term due to various factors such as the falling birthrate, aging population and customer manufacturing bases migrating overseas. Meanwhile, although some uncertainties remain with respect to overseas economic prospects, overall we expect the global economy to continue expanding gradually.

Amidst this economic environment, in December 2014, the UACJ Group announced its three-year mid-term management plan, “Global Step I,” for fiscal 2015-2017. Under this plan, we are targeting specific developments for each business sector with the aim of creating revenue bases capable of withstanding economic change and achieving sustainable growth.

The plan has three major policies:

- Expand growth products in the transportation field—focusing on automobiles—and the energy field, and strengthen business in growth regions such as Asia,

- Construct an optimal production network for each business sector utilizing the synergies created through unification, and

- Develop unique technologies and products by applying our vast technological prowess to fundamental research.

By enhancing these initiatives, our aim is to improve the Group's financial structure and invest in growth. As a result of these efforts, we intend to win the competition with major global aluminum companies and companies newly entering the rolling business, and further augment corporate value as we strive to achieve ongoing growth in expanding markets.

To secure the ongoing trust of our stakeholders, we are concentrating on CSR initiatives. The Group will steadily enforce the management philosophy and Code of Conduct, and ensure thorough compliance and risk management in order to enhance corporate governance, thereby fulfilling corporate responsibilities as a global company.

Financial Performance Forecast for the Next Term

Regarding the sales forecast for fiscal 2015, while expenses are expected to be incurred as the result of continued construction at the Rayong Works of UACJ (Thailand) Co., Ltd. (UATH), we also anticipate positive ongoing effects from the merger. Consequently, we are forecasting net sales of ¥640.0 billion, operating income of ¥26.5 billion, ordinary income of ¥23.0 billion and net income this term attributable to parent company shareholder's equity of ¥11.0 billion.

Rolled Aluminum Products

With shale gas imports from the United States and Canada scheduled to commence, we anticipate an increase in sales of thick plate used in the construction of LNG tankers.

For fiscal 2015, we forecast net sales of ¥500.4 billion and operating income of ¥27.0 billion.

Wrought Copper Products

We will work to develop and expand the sales of unique products that capitalize on advantageous technologies such as our internally grooved tubing compatible with new refrigerants and Thermoexcel heat-transfer pipe with a micro-finned outer surface. We will also strive to increase profits by maximizing the use of existing facility capabilities and strengthen the competitiveness of overseas business, centering on growth markets such as India and the Middle East.

For fiscal 2015, we forecast net sales of ¥57.9 billion and operating income of ¥1.4 billion.

Precision-machined Components and Related Businesses

We plan to further reinforce our business foundation while developing new areas of demand in various sectors such as our automotive and heating businesses. At the same time, we are implementing initiatives to increase global expansion. For example, we have established a new automotive parts manufacturing and sales subsidiary in Mexico, a principal market where automobile production is being concentrated.

For fiscal 2015, we forecast net sales of ¥179.6 billion and operating income of ¥4.4 billion.

3. Returning Profit to Shareholders

Dividend Policy

We believe it is important to return profits to shareholders in the form of dividends. While our basic policy is to provide stable and sustainable dividends, we also comprehensively consider a variety of factors when making decisions on dividend amounts. These factors include trends in corporate performance, securing funds to invest in improving corporate value and R&D to boost competitiveness, and strengthening our financial standing.

Our general policy is to pay dividends twice annually: an interim dividend that is decided by the Board of Directors, and a fiscal year-end dividend that is decided at the General Meeting of Shareholders. For fiscal 2014, the year-end dividend was ¥3, the same amount as the interim dividend. Our dividend forecast for fiscal 2015 is an interim dividend of ¥3 per share and a fiscal year-end dividend of ¥3 per share, for a combined total of ¥6 for the year.

4. Financial Position

Balance Sheet Analysis

As of March 31, 2015, total assets were ¥678.0 billion, up ¥69.5 billion compared to the previous term. This rise was mainly attributable to capital investment at the UATH Rayong Works and currency exchange conversion resulting in a lower yen.

Total liabilities were ¥490.8 billion(up ¥50.5 billion compared to the same term), mainly because of higher loans payable for the aforementioned capital investment.

Net assets rose to ¥187.1 billion (up \19.0 billion compared to the same term), with retained earnings increasing following the posting of net income and an increase in currency conversion adjustments as well.

Research and Development

We are positioning fiscal 2015, the first year of the new mid-term management plan, as the base year for reinforcing our foundation. To achieve this, we will secure the trust of customers and business partners through the continuous creation and supply of products, technologies and services that are safe and beneficial to society.

Based on this policy, the Research and Development Division is building a system that facilitates our ability to make use of comprehensive Group capabilities. To this end, we have concentrated key development activities and facilities in Nagoya, and moved some functions to Fukaya and Fukui.

In fiscal 2014, total R&D expenditures amounted to ¥4.6 billion.

Rolled Aluminum Products

In our mainstay category of aluminum sheet products, we are pursuing R&D to meet increasingly diverse and sophisticated needs in areas such as can stock, BiW panels, automotive heat exchanger materials, thick plate for LNG tankers and lithium-ion battery current collectors. To raise productivity and lower manufacturing costs and environmental impact, we are developing new processes from both tangible and intangible perspectives. Aiming to develop new alloys that can be used in the construction of next-generation aircraft, we are participating in the Innovative Structural Materials Project, a business commissioned by Japan's Ministry of Economy, Trade and Industry.

Regarding extruded products, we are developing automotive heat exchanger materials—an area of strength—and pushing forward with the development of aluminum alloy materials to meet new demand in areas such as aircraft and automotive parts, and heat exchangers for air-conditioners.

Regarding casted products, we are proactively developing high-value-added aluminum components such as compressor wheels, which only a few companies worldwide have the ability to manufacture. In materials for motorcycles, we are developing new high-strength materials and processing methods that continue to receive excellent evaluations from the market, including winning the 49th Oyamada Medal from the Japan Institute of Light Metals.

R&D expenditures for rolled aluminum products in fiscal 2014 totaled ¥4,484 million.

Wrought Copper Products

In the wrought copper products segment, we are developing high-strength copper pipe for air-conditioners, contributing greatly to the development and mass production of air-conditioners that with increasingly higher performance and greater energy savings. Other activities include progressing in the development alloys and manufacturing equipment that increase the corrosion resistance of copper tubing and piping used for air-conditioners and construction. We are also proactively pursuing publicity activities to promote the spread of these leading-edge technologies.

R&D expenditures for wrought copper products in fiscal 2014 totaled ¥114 million.

Precision-machined Components and Related Businesses

In the precision-machined components and related businesses sector, we are developing and producing cooling devices for high-performance, precise power control units. Moving forward, we will work to expand sales to meet expected increases in demand for high-end applications. Regarding heat exchangers for air-conditioners, applying the Group's comprehensive technological expertise and technologies accumulated in the materials and assessment fields, we have begun the mass production of all-aluminum heat exchangers.

As regulations regarding fuel efficiency grow stricter, the automotive industry is increasing its focus on developing lighter-weight automobiles. Addressing this need, we have succeeded in commercializing a globally compatible ultralight aluminum bumper system. By providing this technology to customers, our aim is to contribute to reducing environmental impact throughout society as a whole.

R&D expenditures for precision-machined components and related businesses in fiscal 2014 totaled ¥21 million.

Capital Investment

Construction of the UATH Rayong Works continued in fiscal 2014, with Phase 2 investment (fully-integrated manufacturing beginning from casting processes) covering the installation of equipment and trial operations. The fully-integrated manufacturing system commenced operation in August 2015.

In Japan, optimizing our product mix at manufacturing bases is a priority measure of the mid-term management plan. Capital investment was focused on this area, and we invested where upgrading deteriorating facilities was necessary.

As a result, total capital investment came to ¥46.5 billion in fiscal 2014.

Analysis of Capital Resources and Funding Liquidity

Analysis of Cash Flows

Cash and cash equivalents totaled ¥20.9 billion as of March 31, 2015, up ¥3.5 billion from the previous term.

The situation and factors for cash flow from each activity are as follows:

(Cash Flow from Operating Activities)

Net cash provided by operating activities was ¥26.8 billion, an increase of ¥12.5 billion compared to the previous term. The main sources of cash were income before income taxes and minority interests, which rose substantially due to the expanded business scale as a result of the merger, and depreciation and amortization minus cash outlays.

(Cash Flow from Investing Activities)

Net cash used in investing activities totaled ¥49.7 billion, an increase of ¥24.2 billion compared to that used in the previous term. The primary use of cash was for purchasing property, plant and equipment—including ongoing construction at the UATH Rayong Works—totaling ¥43.9 billion; up ¥19.1 billion compared to that used in the previous term.

(Cash Flow from Financing Activities)

Net cash provided by financing activities totaled ¥25.7 billion, an increase of ¥11.6 billion compared to the previous term. The primary reason was borrowing to raise funds for capital investment in addition to internal funding.

Analysis of Capital Funding and Liquidity

As capital investment related to construction of the UATH Rayong Works increased in fiscal 2014, necessary funds were obtained using funds on hand and loans payable. As a result, the consolidated balance of interest-bearing debt at the end of the term was ¥296.0 billion (up ¥39.6 billion compared to the previous term).

Additionally, borrowing from financial institutions and the issuance of commercial paper during fiscal 2014 had no impact on capital funding capacity, thereby maintaining fund liquidity.