Performance by Business

- Rolled Aluminum Products Business

- Wrought Copper Products Business

- Precision-machined Components and Related Businesses

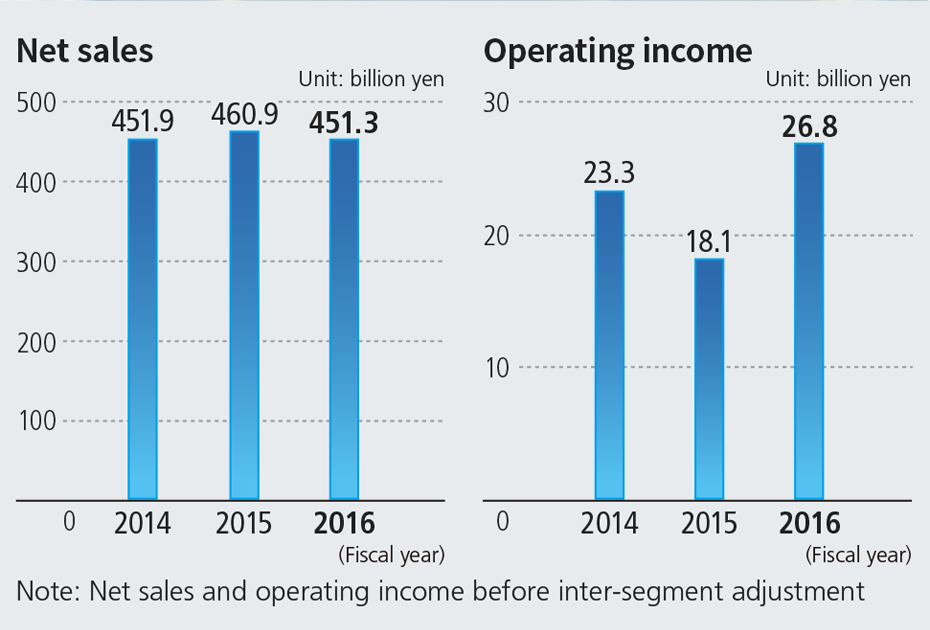

Rolled Aluminum Products Business

In fiscal 2016, the sales volume of rolled aluminum sheet totaled 1.021 million tons, up 51,000 tons year-on-year and surpassing the 1 million-ton mark for the first time since integration. By region, the volume is more or less balanced between Japan and overseas. By type of product, demand remained strong and sales volume increased year-on-year for our mainstay can stock, partly because of fully-integrated manufacturing at the UATH Rayong Works. Automotive materials experienced a substantial increase thanks to growing demand in Japan and overseas as the shift towards aluminum continues to progress. The sales volume of thick plate also rose as a result of buoyant demand for liquid-crystal and semiconductor manufacturing equipment. The total shipment volume of extruded products exceeded the previous year’s level for the first time in three years in the wake of strong demand.

Despite buoyant sales volumes, total net sales declined 2.1% year-on-year to 451.3 billion yen. This was due to a fall in primary aluminum ingot price and a negative impact brought on by foreign exchange rates. On the other hand, operating income rose to 26.8 billion yen, up 47.7% year-on-year thanks to the increase in sales volume, benefits from cutting cost and the shrinking adverse effect of inventory valuations compared to a year earlier.

In fiscal 2017, we expect the sales volume to continue to increase, mainly in the areas of can stock and automotive materials. The increased supply at UATH Rayong Works is likely to lead to overseas sales volume outperforming domestic volume for the first time. Taking all of this into account, we project increases in both sales and operating income, rising to 501.1 billion yen and 34.9 billion yen, respectively.

Product mix of rolled aluminum products and main customers

| Product uses | Fiscal 2016 sales volume | Main customers | Main end-product manufacturers | |

|---|---|---|---|---|

| (Unit: 1,000t) | (as % of total) | |||

| Can stock | 626 | 61% | Can manufacturers | Beverage/Food manufacturers |

| Foil | 47 | 5% | Foil manufacturers | Pharmaceutical/Food manufacturers |

| IT | 20 | 2% | Electronic parts manufacturers | IT equipment manufacturers |

| Automotive | 104 | 10% | Automobile/Parts manufacturers | Automobile manufacturers |

| Thick plate | 67 | 7% | Metal trading companies Shipbuilders |

Liquid crystal/Semiconductor production equipment manufacturers Shipbuilding |

| Other generalpurpose materials | 158 | 15% | ||

| Total | 1,021 | 100% | ||

| For Japanese market | 518 | 51% | ||

| For overseas markets | 503 | 49% | ||

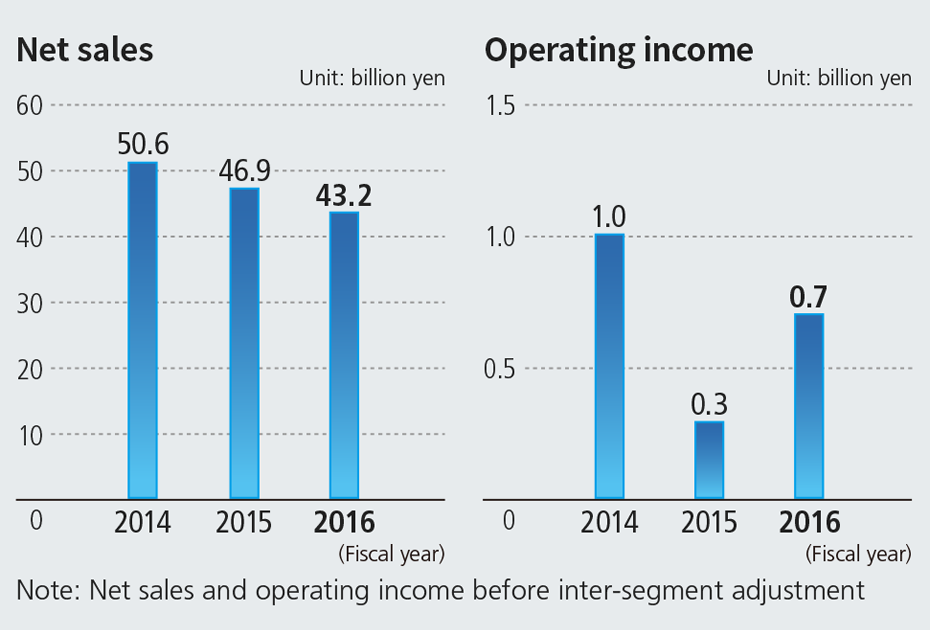

Wrought Copper Products Business

In fiscal 2016, the sales of wrought copper products fell 7.9% year-on-year to 43.2 billion yen. This is despite solid shipments of air conditioners, the main use of the products, as the primary copper ingot price was sluggish compared to the previous year. On the other hand, operating income surged to 700 million yen, up 107.5% year-on-year as a result of improved inventory valuation and the effects of cost reductions.

In fiscal 2017, the sales volume is expected to continue to grow thanks to the brisk shipment of air-conditioners. Consequently, we project increases in both sales and operating income to 48.5 billion yen and 1.6 billion yen, respectively.

Precision-machined Components and Related Businesses

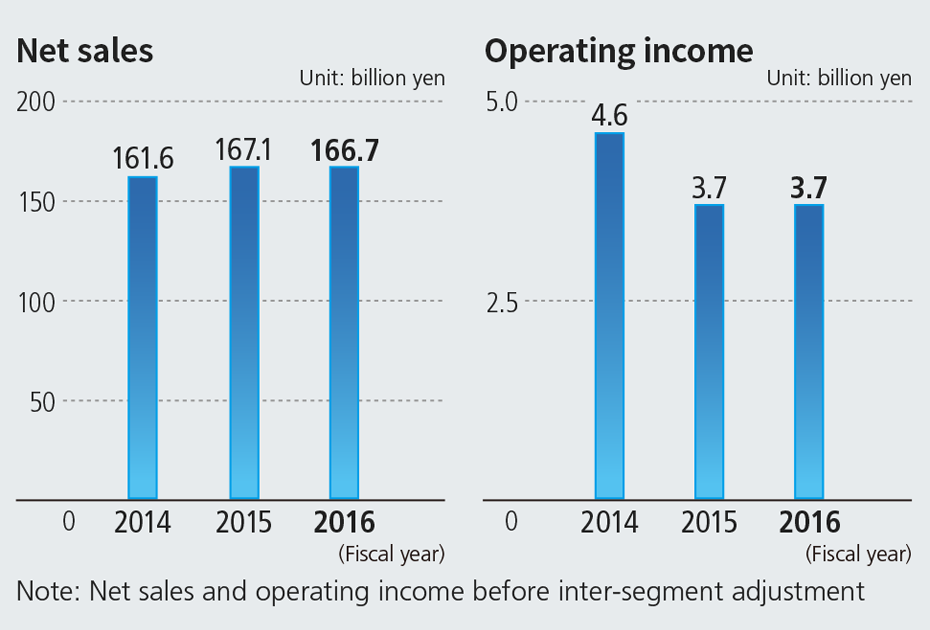

In fiscal 2016, despite acquiring present-day UACJ Automotive Whitehall Industries, Inc. (UWH) and its subsequent addition to the consolidated account, sales in this segment slipped to 166.7 billion yen, down 0.2% year-on-year. This was due to the adverse effect of lower demand in existing businesses. Operating income also slid to 3.7 billion yen, down 0.1% year-on-year, due to slower sales and the amortization of goodwill accompanying the purchase of UWH.

In fiscal 2017, a full-term contribution towards the consolidated account is expected from UWH and brisk sales of air-conditioner compressor fin materials is anticipated for the Japanese market. Consequently, we project increases in sales and operating income to 181.8 billion yen and 4.9 billion yen, respectively.

- Performance by Region