Mid-term Management Plan

- HOME

- Investor Relations

- Management Policy

- Mid-term Management Plan

Fourth Mid-term Management Plan

FY2024 to FY2027

Becoming a value adding materials company

Value, Connect, and Lightens the World

Market Environment and Business Opportunities

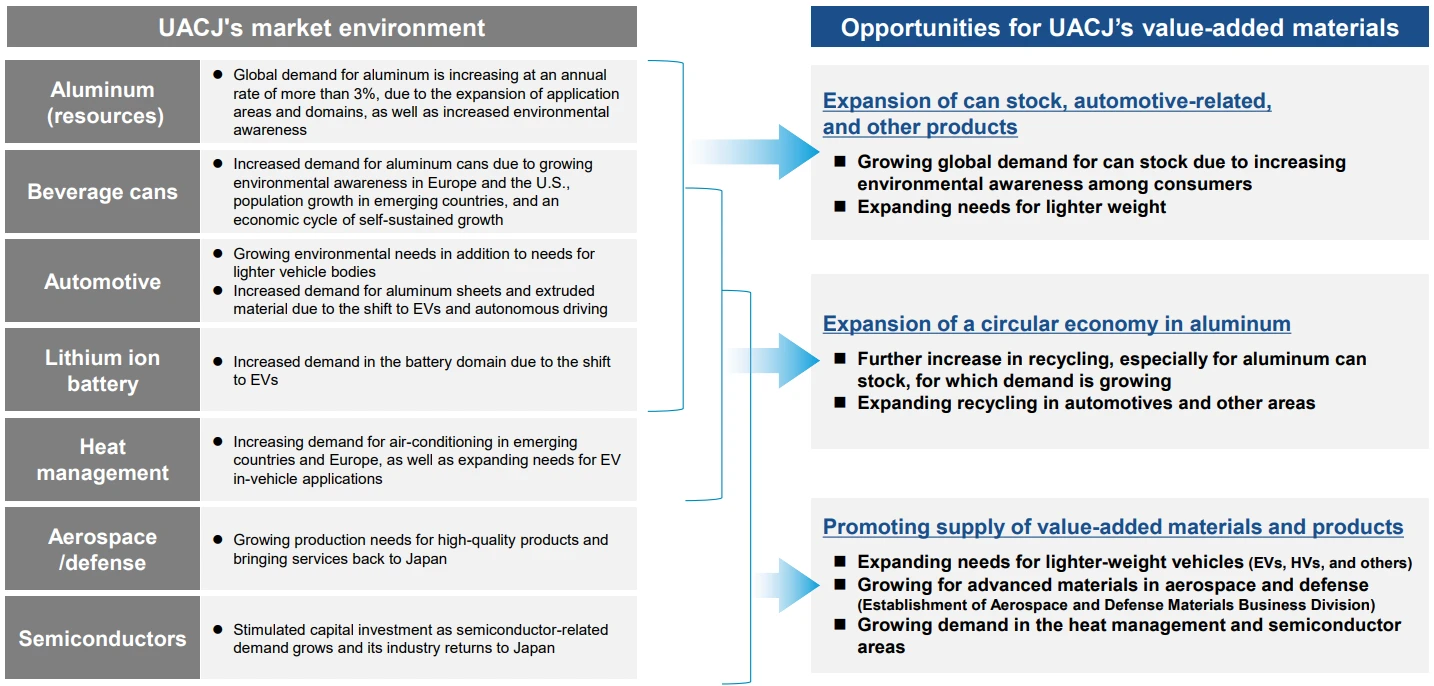

In response to changes in the market environment surrounding our company, business opportunities are expanding through the provision of materials with added value. Demand for can stock is increasing amid the shift away from plastics, and lightweight needs for automotive materials are rising with progress in EVs and autonomous driving. Promoting recycling is also essential for building a circular society. Furthermore, responding to high-function materials in fields such as aviation and semiconductors is expected to lead to new growth opportunities.

Major policies

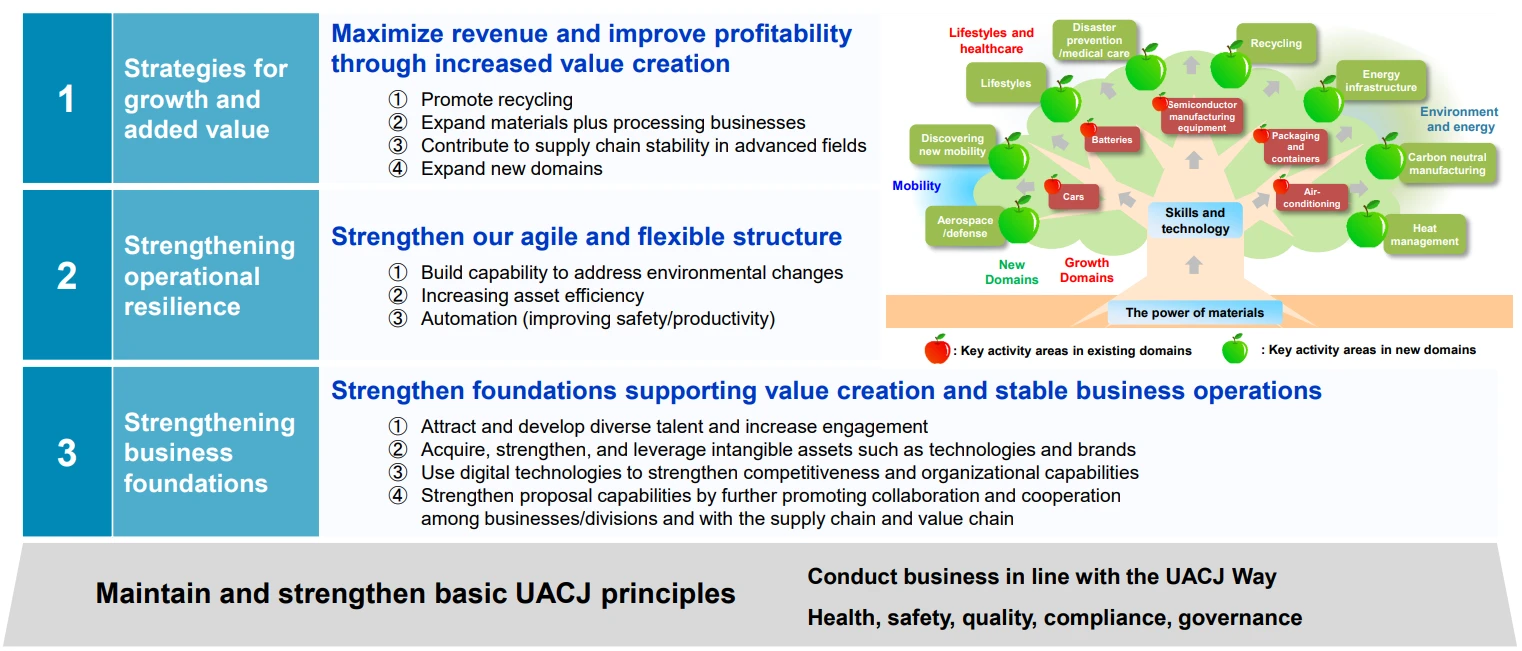

From a provider of materials to a value adding materials company

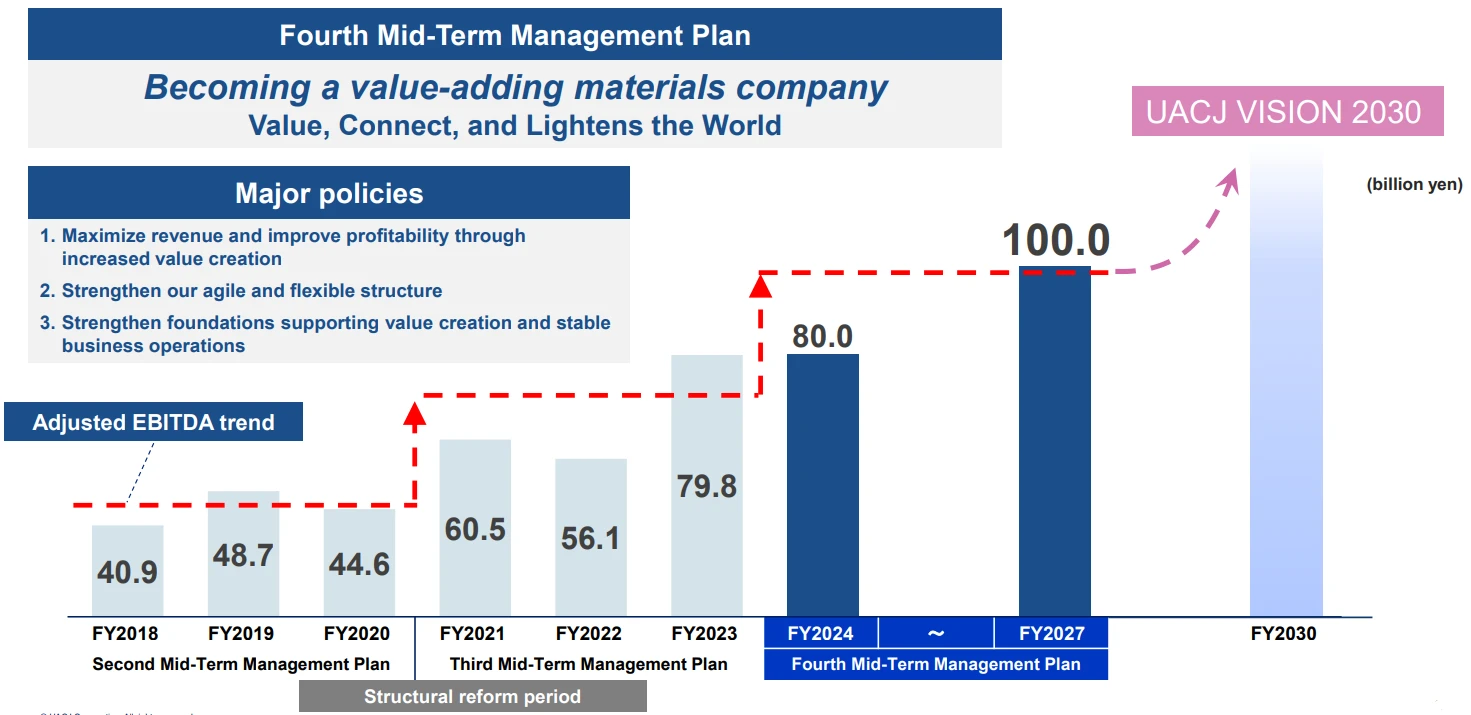

In the Fourth Mid-term Management Plan, transformation into a value adding materials company is positioned as a major policy. With three pillars—(1) maximizing earnings through growth and added-value strategies, (2) toughening business through management speed and flexibility, and (3) reinforcing the base by enhancing the value of intangible assets such as human capital and brand—we aim for sustainable growth that captures environmental changes.

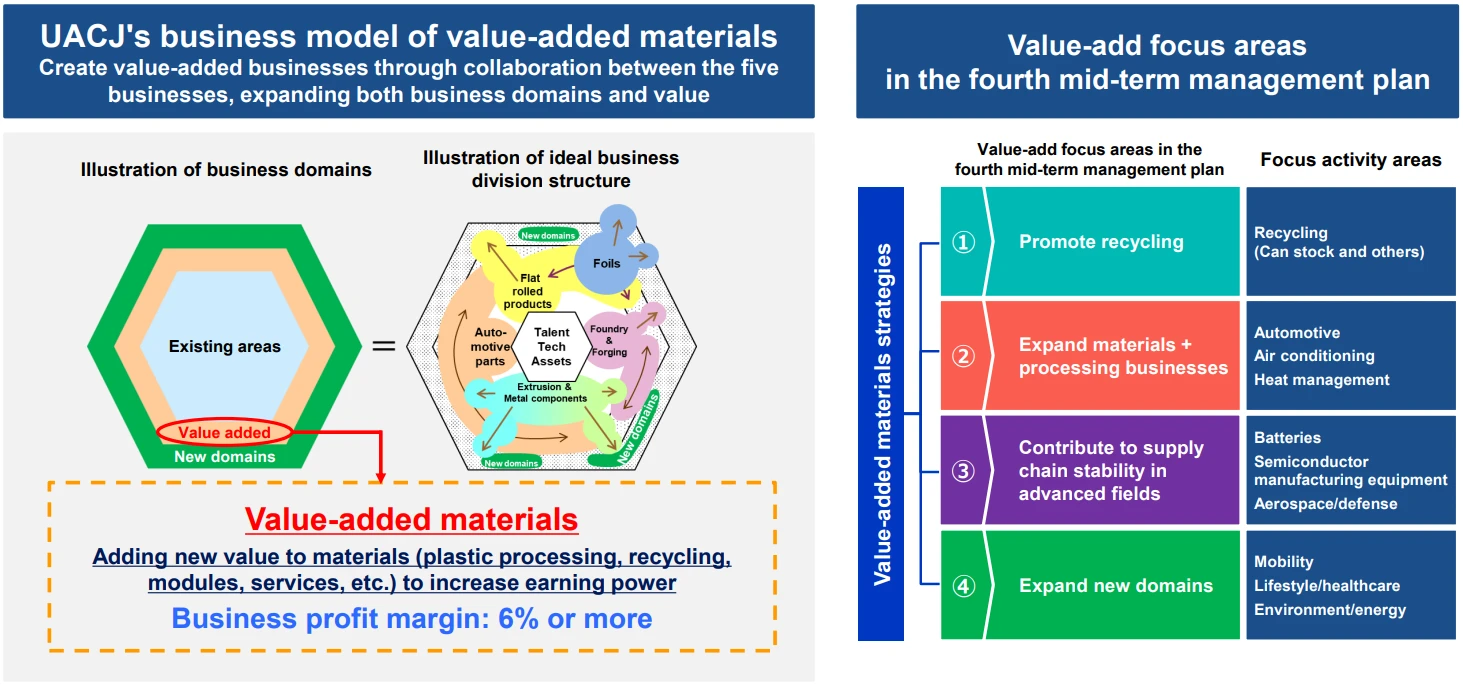

Approach to Business Opportunities: UACJ's Value Added Materials Strategy

In "UACJ VISION 2030," UACJ aims to expand business domains and provide added value, leveraging its strengths. In recycling, resource circulation will be accelerated by expanding the product group including beverage cans; in material + processing, high-added-value solutions will be deployed in automotive and air-conditioning heat management fields. Furthermore, in advanced fields requiring stable supply such as batteries, semiconductor manufacturing equipment, aviation/aerospace, and defense, contribution will be made to strengthening domestic supply chains; while in new domains, further business evolution will be aimed for in the fields of mobility, lifestyle/healthcare and environment/energy.

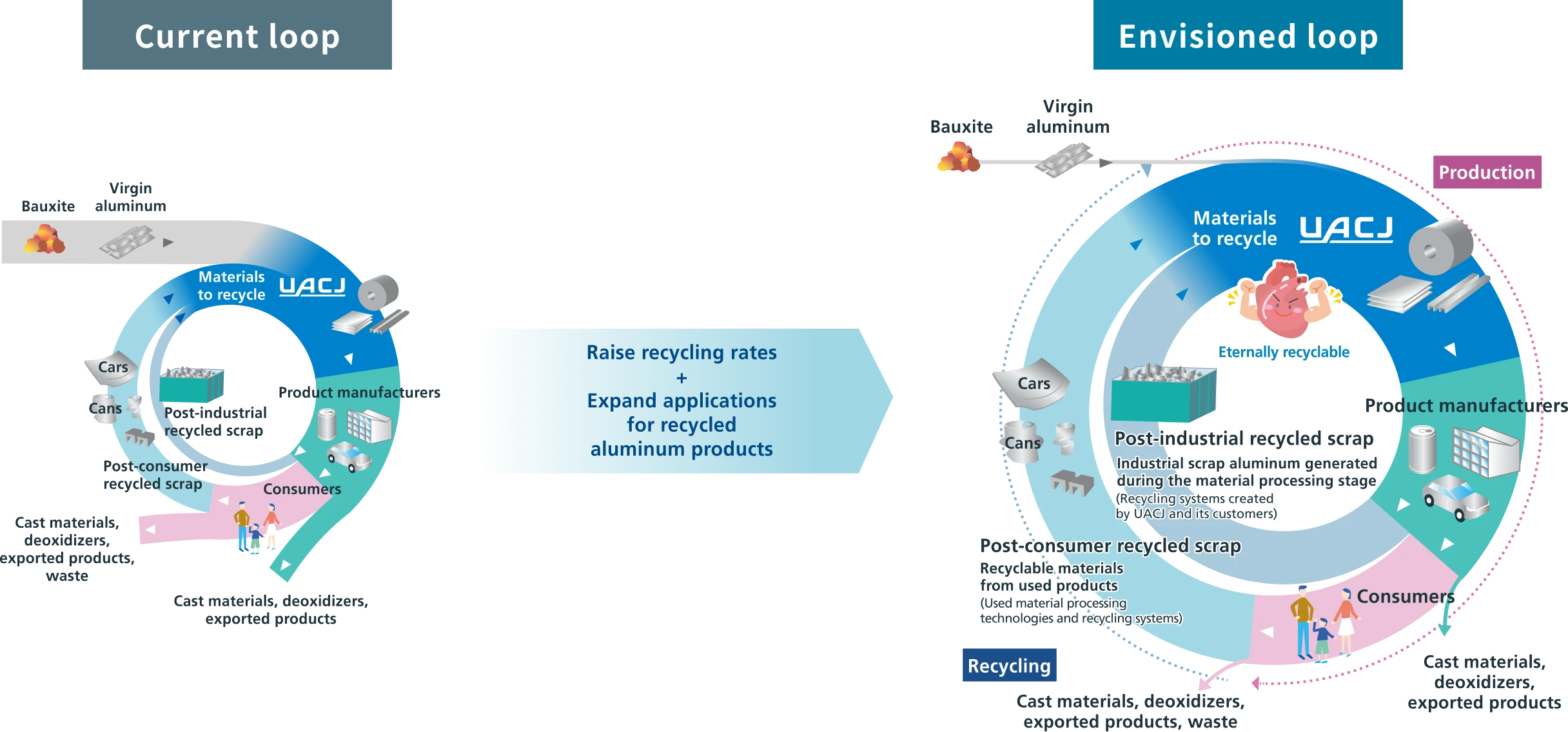

Promote Recycling: Future Challenges and Vision

Leading the way to a circular economy with aluminum, transforming business models

UACJ aims to concentrate its technology, equipment, and development capabilities to thicken and enlarge the trunk of the recycling loop circulation. UACJ will become the heart of aluminum's circular economy, expanding business upstream and downstream to broaden its revenue foundation.

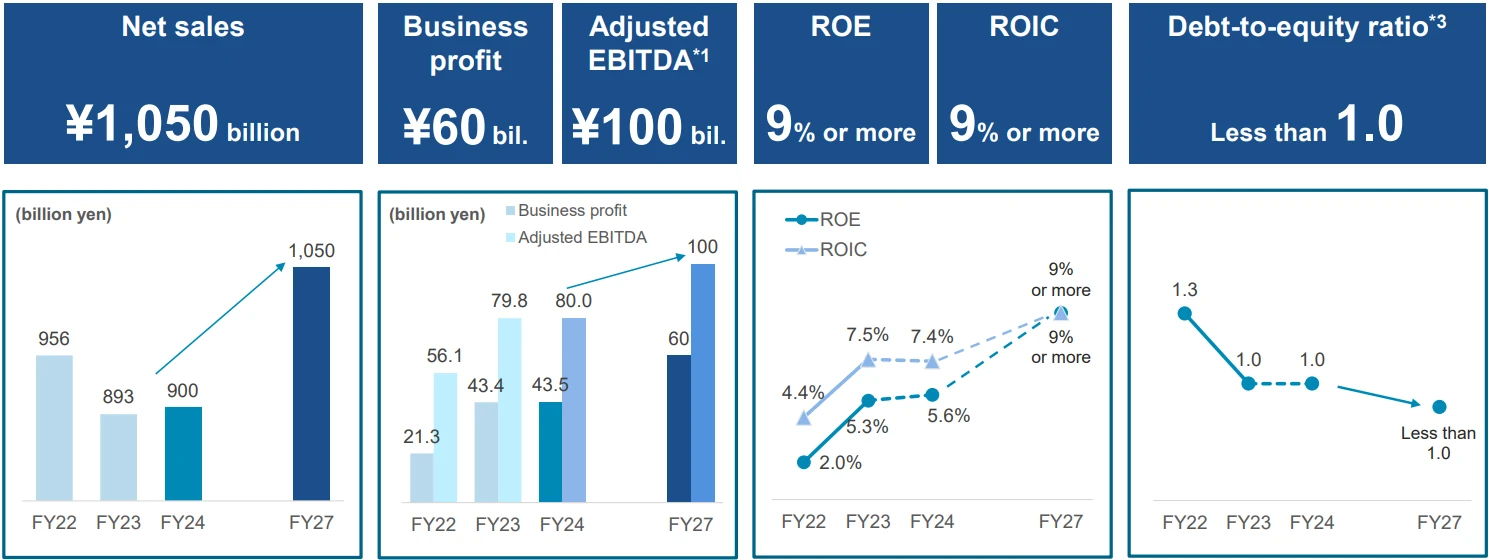

Financial targets

Targets for FY2027: Business profit of ¥60 billion, ROE of 9%, ROIC of 9% or more, and create equity spread

- Results of sustainable business activities: Operating income minus inventory impact and temporary or specially significant gains and losses

- Adjusted EBITDA=EBITDA minus inventory valuation effects

- ROIC is calculated based on pre-tax business profit

- Debt-to-equity ratio excludes subordinated loans

Positioning of the Fourth Mid-term Management Plan

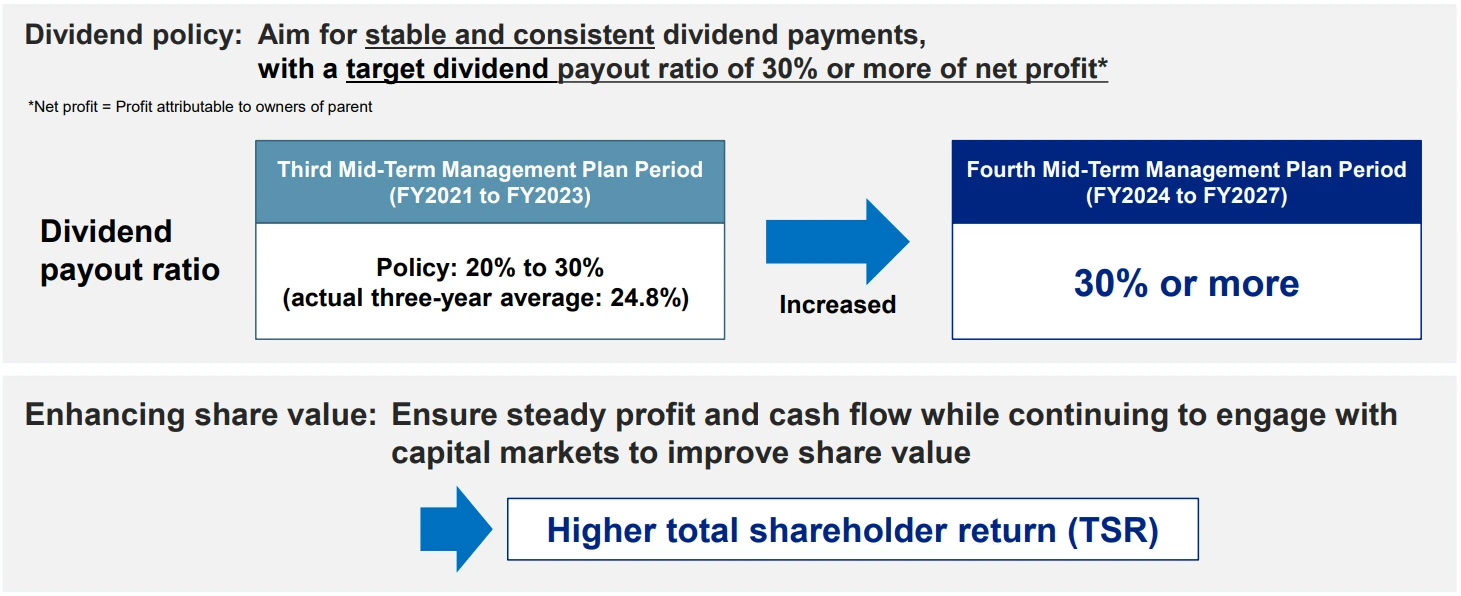

Shareholder return policy

Dividend policy and enhancing share value

Aim for stable and consistent dividend payments, with a target dividend payout ratio of 30% or more of net profit

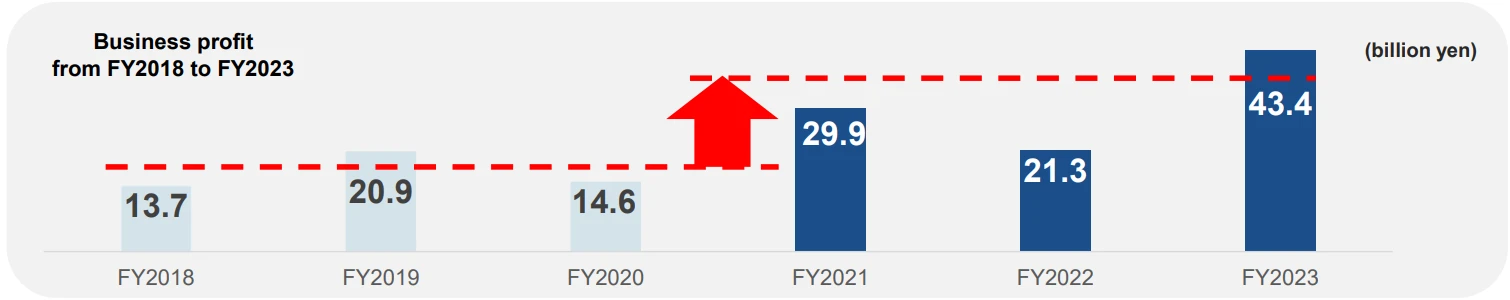

Review of Previous Mid-Term Management Plan

Review of the Third Mid-Term Management Plan: Major Financial Targets and Basic Policies

Achieved most financial/action targets thanks to completing structural reforms as well as profit contributions from overseas businesses

Basic Policies

Complete structural reforms(to Mar 2023)

- Profit improvement target of ¥21 billion (BM: FY2019)

- Lower break-even point 10% from FY2019 to FY2022

- Consolidate manufacturing bases completed and optimal manufacturing system built up

- Reduce D/E ratio (from 1.7 in FY2019 to 1.3 in FY2022)

- Reduce director and executive officer headcount

Strengthen foundations for growth

- Invest in North American can stock and automotive areas

- Decide to make recycling-related investments in Japan, the U.S., and Thailand

- Strengthen partnerships/collaboration with customers to create a circular economy in aluminum

- Expand and achieve profit in priority activity areas

Promote global sustainability

- Establish a foundation for sustainability activities

- Form company-wide working groups by theme in environmental domains to strengthen initiatives

Major Financial Targets

| Financial indicators | FY2023 plan targets | FY2023 results |

|---|---|---|

| Net sales | ¥700 billion | ¥892.8 billion |

| Business profit | ¥32.7 billion | ¥43.4 billion |

| Business profit margin | 4.7% | 4.9% |

| ROE | 7.5% | 5.3% |

| ROIC*1 | 6.0% | 7.5% |

| Debt-equity ratio*2 | 1.2or less | 1.0 |

*Assumptions for plan: ¥110/US$; LME = US$2,050/t; Crude oil (Dubai) = US$60/barrel

- ROIC is calculated based on pre tax business profit

- Debt to equity ratio excludes subordinated loans

Review of the Third Mid-Term Management Plan: Highlights

Varied reforms have further boosted domestic & overseas business earnings

Complete

structural reforms

- Lower break-even point

- Establish optimal production system

- Business selection and concentration

- Reduce director and executive officer headcount

Reform

price-setting structure

- Introduce energy surcharge system

- Scheme for passing on rising logistics costs

- Increase roll margins due to price hikes and environmental investments

Expand overseas

business

earnings contribution

- TAA: Significant revenue expansion

- UATH: Factory launch, profit expansion

- UWH : Strategic investment

Fourth Mid-term Management Plan (presentation materials)

Fourth Mid-term Management Plan FY2024 to FY2027

Announcement date: May 13, 2024

Fourth Mid-term Management Plan for Fiscal 2024 to 20274.46MB

Fourth Mid-term Management Plan for Fiscal 2024 to 2027 Summary1.73MB

-

Some of the information posted on our website contains references to future results. The posting of such information does not constitute a guarantee of future results, and the information is subject to risk and uncertainty. Please be aware of the possibility of different future results caused by changes in the environment or similar factors.