Message from the President

- HOME

- Sustainability

- Message from the President

Raising the value of the UACJ Group by leveraging aluminum’s unlimited possibilities

Shinji Tanaka

Representative Director,

President

Looking back on fiscal 2024

Revenue and profits exceeded initial forecasts as we captured robust global demand for aluminum products

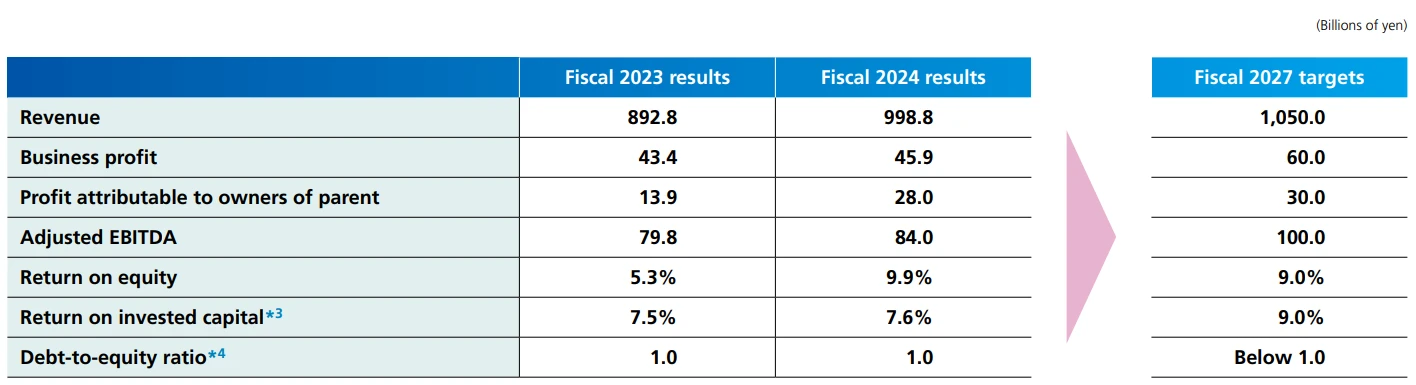

In fiscal 2024, the Company’s fiscal year ended March 31, 2025, we launched our fourth mid-term management plan extending through fiscal 2027. We formulated this four-year plan by backcasting from our fiscal 2030 financial and nonfinancial goals with a view to realizing UACJ Vision 2030, the UACJ Group’s long-term roadmap. Under the plan, we are working to increase revenue and profits by steadily capturing global demand for aluminum products. Moreover, by reducing environmental impacts through aluminum recycling and expanding our fabricated material businesses, we intend to supply aluminum materials with even more value than before. By fiscal 2027, the final year of the plan, we are targeting ¥1,050 billion in revenue, ¥60 billion in business profit*1, and ¥100 billion in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA)*2.

In fiscal 2024, the Company posted higher revenue and profits than the previous fiscal year—exceeding initial forecasts—including ¥998.8 billion in revenue, ¥45.9 billion in business profit, ¥28.0 billion in profit attributable to owners of parent, and ¥84.0 billion in adjusted EBITDA. This was mainly thanks to the Group’s success in capturing robust demand for can stock, especially in the North American market. It also reflected solid returns on investments in subsidiaries Tri-Arrows Aluminum Inc. and UACJ (Thailand) Co., Ltd., for expanding their production capacity, which was initiated in anticipation of growing global demand for aluminum products. Market factors also contributed to net profit as inventories were positively affected by rising market prices of virgin aluminum.

- Business profit is operating profit excluding the effect of the metal price lag as well as temporary and extraordinary factors.

- Adjusted EBITDA is EBITDA excluding the effect of the metal price lag.

Executing our fourth mid-term management plan

Making the most of opportunities from changes in the operating environment

During the four years of our fourth mid-term management plan, we will lay foundations for growth from fiscal 2024 to 2025, and then prepare to generate substantial returns on prior investments from fiscal 2026. At the time of formulating the plan, however, we did not expect certain changes in the Group’s operating environment. Therefore, we will try to make the most of opportunities that these changes bring while taking whatever measures are necessary to manage associated risks.

Among the changes, tariffs imposed by the United States following the changeover of its government are having a major impact on business conditions around the world. Our operating environment is also affected, but given that the tariffs are aimed at reducing imports and reviving domestic manufacturing, they also create opportunities for the UACJ Group to grow considerably since Tri-Arrows Aluminum manufactures rolled aluminum products and UACJ Automotive Whitehall Industries makes automotive parts in the U.S.

We expect Tri-Arrows Aluminum, in particular, to meet demand for aluminum can stock in the U.S. market, given its plan to expand production capacity of hot rolling lines by over 10% from fiscal 2026. In fact, it has already concluded contracts with customers for several years ahead. Supply is extremely tight in the American can stock market and imports are projected to decline due to the tariffs, so we believe demand conditions will remain favorable even if other manufacturers boost production capacity.

Can stock exported from Thailand to the U.S. will be directly targeted by the tariffs, but since previously contracted shipments are exempt, UACJ (Thailand) does not expect any major changes to its sales volume in fiscal 2025. From fiscal 2026, the company plans to shift its focus from the U.S. and supply products to other regions in order to maintain sales growth, as it receives many inquiries from Australia, India, and countries in Southeast Asia and the Middle East. In addition, the Group’s operations in Japan will be impacted by the tariffs if Japanese automakers reduce their exports to the U.S., so we will closely watch these developments.

Turning to the global market for electric vehicles (EVs), growth has decelerated and major manufacturers are reconsidering their production plans. Nevertheless, we believe the general shift to EVs will continue over the medium and long terms, and the market is currently cooling off before the next wave of growth. Aluminum parts are expected to be more widely adopted to help decrease overall vehicle weight, which has been on the rise due to increasingly large battery capacity, so we will consider growth investments at an opportune time when the EV market is poised to expand again.

In Japan, to deal with rising costs of labor, processing, logistics, maintenance, and various products we procure, including secondary materials, we revised prices of all of UACJ’s products effective from April 1, 2025. Looking ahead, we will continue working to offer more value in our products and reflect this in product prices.

Fiscal 2024 results and targets of the fourth mid-term management plan

- ROIC is calculated based on business profit before taxes.

- The debt-to-equity ratio excludes subordinated loans.

Steady global growth in demand for mainstay aluminum can stock

Having completed the first fiscal year of our current mid-term management plan, we renewed our conviction in the future growth and potential of the aluminum products industry. We expect even more opportunities for the Group’s mainstay business of rolled aluminum for beverage cans, in particular, as global demand for aluminum can stock has been growing at a compound annual rate of 3% to 4%.

In North America, people have been steadily turning to aluminum cans and away from plastic containers amid concerns about the health hazards of microplastics. Aluminum cans are increasingly being used for new types of beverages, such as energy drinks and hard seltzers, as their stylish appearance appeals to consumers. If consumers become more aware of how recycling aluminum cans reduces environmental impacts, market growth could accelerate in the future.

In Asia, demand for aluminum cans has been steadily increasing amid rising living standards and population growth. Market growth is also projected in other regions, including Oceania, the Middle East, and Africa. The UACJ Group operates the sole integrated aluminum products factory in Southeast Asia, so it is very well positioned to supply can stock to these markets.

In Europe, glass bottles have traditionally been the main type of beverage container, but the shift to aluminum cans has been picking up gradually. To recycle used glass bottles after they have been reused a certain number of times, a large amount of energy is needed to melt down the glass for new bottles, but energy prices have been rising steeply in recent years, driving up production costs. Consequently, manufacturers have been considering aluminum cans because much less energy is needed for recycling.

In Japan, substantial growth in demand for can stock is unlikely in the future due to the country’s declining population. Nevertheless, we will work to stimulate demand for aluminum cans by raising public awareness of their excellent environmental performance and recyclability.

Internationally, a growing number of major beverage can manufacturers have made certification by the Aluminum Stewardship Initiative (ASI)*5 a basic requirement for suppliers. In July 2020, UACJ became Japan’s first rolled aluminum manufacturer to join the ASI, and in 2022, Fukui Works in Japan and Rayong Works in Thailand both acquired ASI certification, laying a foundation for expanding business through exports to Europe and other regions.

- The ASI is an international organization that aims to “recognize and collaboratively foster responsible production, sourcing and stewardship of aluminum.”

Major growth opportunities for aluminum products in the aerospace and defense materials markets

As growth opportunities for aluminum products broaden across a variety of industries, we are working to expand our business in the aerospace and defense materials markets, which we have positioned as new growth markets. In the aerospace market, demand for new aircraft is projected to grow as new fuel-efficient models become available and passenger volume increases. Moreover, recently low demand for rockets is expected to reverse as more will be needed for launching new satellites, which are increasingly in demand as AI-equipped models attract attention for their disaster monitoring capabilities and other new solutions. Meanwhile, the defense materials market is being impacted by Japan’s plan to dramatically increase its defense budget in response to a variety of factors. In fact, defense expenditures of ¥43 trillion in the government’s current five-year budget (fiscal 2023 to 2027) are 2.7 times higher than in its previous fiveyear budget*6, so demand for defense materials is projected to increase accordingly.

To successfully capture demand in these growth markets, we established the Aerospace and Defense Materials Business Division in October 2024 as an organization capable of offering one-stop services to a wide range of customers. To boost production capacity of quenched aluminum thick plate, which is used in the aerospace, defense, and semiconductor manufacturing industries, we decided to install one of the country’s largest manufacturing lines at Fukaya Works. About ¥11 billion will be invested in this line, which is scheduled to begin operating in the second half of fiscal 2027.

A distinctive feature of Japan’s aerospace and defense materials market is that the government has a strong preference for procuring products domestically for the purpose of national security. At present, only a limited number of manufacturers can supply these products in Japan. UACJ has the country’s top production capacity, so its aerospace and defense materials business has great potential to grow substantially in the future.

- According to the annual white paper, Defense of Japan 2024, published by the Ministry of Defense.

Expanding aluminum recycling worldwide

Aiming to use recycled aluminum in all products by 2050

UACJ’s corporate slogan, “Aluminum lightens the world,” reflects our aspiration to contribute to the world’s sustainability by maximizing the potential of aluminum to lower environmental impacts.

Aluminum has many beneficial properties, but the fact that it is relatively easy to recycle is the biggest benefit in terms of finding solutions for environmental issues and creating economic value. It is a metal that can be recycled almost endlessly, and the energy needed to produce recycled aluminum is only about 3% of the amount needed to produce the same volume of virgin aluminum in the smelting process. Therefore, recycling aluminum over and over again can greatly contribute to reducing environmental impacts. In addition, for countries like Japan that must import virgin aluminum, recycling used aluminum products domestically also has the added benefit of strengthening economic security.

We have been working hard to expand our recycling initiatives with the goal of increasing UACJ’s recycling rate*7 to 80% by 2030. By 2050, our goal is to use recycled aluminum as raw materials for all of the Group’s products—completely eliminating the use of virgin aluminum—in an effort to expand aluminum recycling in Japan and Thailand and help build a circular economy. Increasing the recycling rate is not easy, but the Company successfully boosted the rate to 74% in fiscal 2024, beating initial targets. In Japan, almost 100% of beverage cans are collected for recycling, but more systems are needed for collecting and recycling many other types of used aluminum products. Therefore, we are working to build and reinforce such systems, which will also include separating and sorting collected products, across the supply chain together with the manufacturers we supply products to as well as various other partners.

In 2025, the Japanese government declared its intention to facilitate the recycling of plastics, aluminum, and other metals as part of its national policy of promoting a green transformation*8. As a member of UACJ—a company that has been promoting aluminum recycling while stressing the importance of a circular economy—I am extremely impressed and gratified by this landmark decision to include aluminum in this national policy for the first time. Inspired by this development, we will continue working to broaden applications for aluminum, promote recycling, and expand the scale of an aluminum circular economy worldwide in partnership with all kinds of stakeholders.

- UACJ’s recycling rate is an indicator of the proportion of aluminum it recycles, calculated by dividing the amount of used and scrap aluminum by the total amount of aluminum melted down in furnaces.

- Stated in the draft outline of Basic Policy on Economic and Fiscal Management and Reform 2025, issued by the Cabinet Office in June 2025

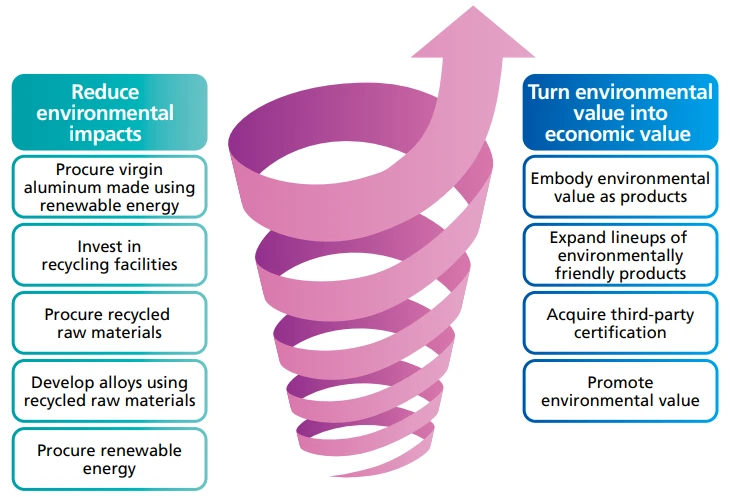

Working to convert environmental value into economic value

Converting environmental value into economic value

The aluminum industry has been adding value to products for many years, but it has also faced difficulties in having this recognized in the market. With this in mind, we are spearheading initiatives to supply aluminum materials with even more value than before and have positioned recycling at the heart of our growth strategies in our mid-term management plan.

The Group adds value by reducing environmental impacts, specifically by developing aluminum alloys that can be recycled, procuring recyclable raw materials, and investing in recycling facilities. Then by embodying that value in the form of environmentally friendly products and selling them to customers, we turn environmental value into economic value. Conceptually, by reinvesting the capital created from economic value in activities for reducing environmental impacts, the UACJ Group can generate a cycle of creating environmental value and converting it to economic value, thereby contributing to sustainability more broadly. During the four years of our current mid-term management plan, we will install recycling equipment at the Group’s main production facilities in Japan, the United States, and Thailand, in line with our policy to expand recycling capacity through proactive capital investment.

In recent years, a growing number of companies have expressed their desire to use recycled aluminum, including beverage can stock manufacturers at the forefront of efforts to recycle aluminum, automakers that use large volumes of aluminum, and also manufacturers of air conditioners and computers. In our negotiations with such companies, the topic increasingly turns to the extent that they will be able to reduce greenhouse gas emissions by using recycled aluminum. I believe this widespread recognition of the environmental value of recycled aluminum is one reason why its price is relatively high today.

We will continue responding to their requests and work to win them over in negotiations by demonstrating the environmental value of recycled aluminum.

Empowering human capital

We created a UACJ People Statement after revising our approach to human capital and related policies

To grow sustainably together with communities around the world, we have specified five materiality issues to address on a priority basis. Three of the issues are related to the global environment and the Earth’s future, and two are related to the well-being of people and the health of their communities. We also created our UACJ People Statement and a new framework for human capital management after revising our approach to human capital and various related policies.

Our approach is designed to enhance the well-being of all employees while improving the capabilities of our people and organizations, thereby generating a virtuous cycle that increases the value of the UACJ Group for all stakeholders.

Having been created from the merger of Furukawa-Sky Aluminum Corp. and Sumitomo Light Metal Industries, UACJ is driven by people from diverse backgrounds. To ensure that its diverse members can realize their full potential, we have been revamping the Company’s human resources systems. Furthermore, as part of our efforts to foster a good workplace environment, we are taking proactive measures to help employees manage and improve their health based on the UACJ Group Health Management Policy.

To bring out the best in our people and improve organizational performance, we need to have all members of the Group work toward the same goals with a shared understanding of the UACJ Group Philosophy. Therefore, we have been holding meetings for employees and management to discuss the philosophy since 2020. Following my appointment as president, I began holding town hall-style meetings in fiscal 2024 to strengthen bonds with employees. During that year, I met with employees in 28 meetings held in various locations in Japan and other countries where the Group operates.

The town hall-style meetings provide opportunities for sharing a wide range of information and news about aluminum in addition to discussing the Group’s future goals and measures of the mid-term management plan. I hope the meetings also spark related discussion among the employees who attend them. We have continued to hold meetings in fiscal 2025 with even more employees with a view to fostering shared understanding within the Group and enhancing both individual and organizational performance.

For shareholders, investors, and all other stakeholders

We are aiming to raise the Company’s enterprise value and bring its price-to-book ratio up to at least 1.0

By carrying out structural reforms between 2019 and 2022, the Company has successfully boosted earning capacity and improved its financial structure, thereby establishing a platform for its next series of growth investments. Looking ahead, we will execute these growth investments and various other initiatives with an eye on achieving the targets of our current mid-term management plan. As president, I will lead these efforts while pursuing our goals of increasing the Company’s enterprise value and raising its price-to-book ratio to at least 1.0 as soon as possible.

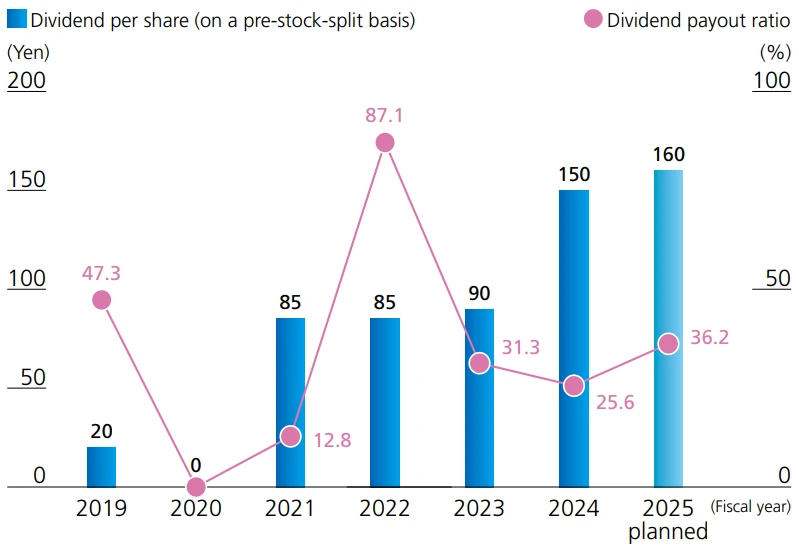

Dividend per share and dividend payout ratio

We will draw on the benefits that come from higher enterprise value to return profits to shareholders through dividends and other means. Thanks to solid results in fiscal 2024, UACJ paid an annual dividend of ¥150 per share, an increase of ¥60 per share compared with the previous fiscal year. Moreover, in February 2025, the Company acquired 3,000,000 of its own shares, equivalent to about 6% of total shares issued and outstanding. In line with our shareholder returns policy of continuously paying stable dividends, we plan to raise the dividend for fiscal 2025 by ¥10 to ¥160 per share*9.

In addition, UACJ conducted a four-to-one stock split of its ordinary shares effective from October 1, 2025. By reducing the amount per share, we made it easier for retail investors to invest in the Company, and this should lead to a higher number of investors overall as well as greater liquidity of the Company’s stock, which has been a challenge in the past.

Now that I have served as president for over a year, I have had opportunities to talk with many stakeholders. Through these discussions, however, I have come to realize that we still have not sufficiently conveyed UACJ’s potential and the possibilities of aluminum to customers, shareholders, and investors. Aluminum is an essential metal for a wide range of industries, and by making the most of its light weight and recyclability, we can greatly contribute to reducing environmental burdens. Therefore, we will more actively explain how this can have a big impact on society and how our aluminum products and recycling activities are generating economic value while providing solutions for people today. In this way, we hope to make UACJ more widely known by the public and enhance its standing in the stock market.

Looking ahead, the Group as a whole will strive to achieve the objectives of its fourth mid-term management plan and realize its long-term roadmap, UACJ Vision 2030. We look forward to the ongoing support of all stakeholders as we pursue these endeavors.

- The dividend per share (with a record date of September 30, 2025) before taking into account the four-to-one stock split effective from October 1, 2025.