Corporate Governance

- HOME

- About Us

- Governance

- Corporate Governance

Enhancing corporate governance to earn stakeholder trust and confidence and increase corporate value

Basic Philosophy of Corporate Governance

We view corporate governance as one of the most important issues to be addressed by management. In order to achieve sustainable growth of the UACJ Group and increase its corporate value over the medium to long term through business activities based on the UACJ Group Philosophy, we are working to develop and enhance an effective governance system, including strengthening management oversight and business execution functions, appropriate disclosure of business information, and thorough compliance and risk management.

Status of Compliance with the Corporate Governance Code

UACJ strengthens corporate governance based on the intent of the Corporate Governance Code. Disclosure of the 14 principles and supplementary principles required by the Tokyo Stock Exchange is presented in the Corporate Governance Report. We will continue strengthening our corporate governance as needed to respond to changes in the environment surrounding our company.

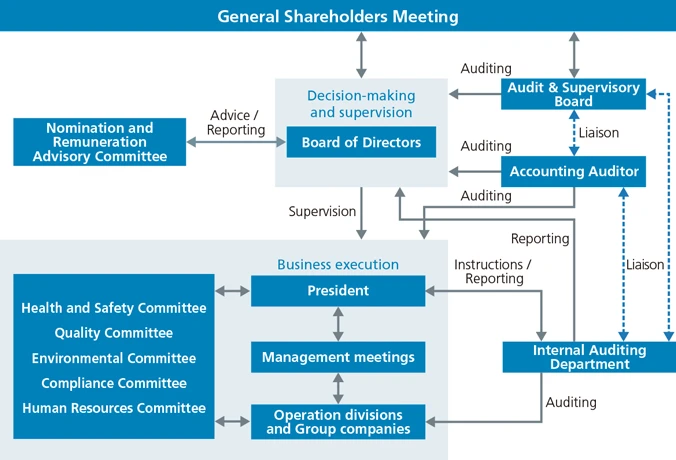

Corporate Governance System

Board of Directors

The Company utilizes an Audit & Supervisory Board system. Following the executive officer system for business execution, managerial decision-making and supervisory functions are separated from business execution, thereby strengthening the functions of the Board of Directors and accelerating the speed of business execution. To further clarify this separation and improve the supervisory function, the Articles of Incorporation stipulate that the president serves as the chief executive officer in charge of business execution.

As of June 20, 2025, the Board of Directors consists of 10 directors (including five independent outside directors) and five Audit & Supervisory Board members (including 3 independent outside members).

Each month, the Board of Directors deliberates on important management matters and reports on the status of business execution, in addition to matters to be resolved in accordance with laws, the Articles of Incorporation, and internal regulations. The Chairman of the Board of Directors is selected by mutual vote, and currently, a non-executive director serves as chairman. In fiscal 2024, in addition to making decisions on capital investments for future growth and supervising the Fourth Medium-term Management Plan, we also leveraged off-site meetings to conduct repeated discussions on key medium- to long-term challenges.

In addition, a Board of Directors Secretariat has been established as a dedicated department to conduct effectiveness assessments and provide support to outside directors, such as by providing various forms of information.

We will continue to operate the Board of Directors in an appropriate manner and work to increase the Group’s corporate value over the medium to long term.

Corporate Governance System

Overview of Corporate Governance System

| Institutional format | Company with an Audit & Supervisory Board |

|---|---|

| Total number of directors | 10 (including 5 outside directors) |

| Total number of Audit & Supervisory Board members | 5 (including 3 outside auditors) |

| Ratio of female directors | 20% |

| Directors’ term of office | 1 year |

| Adoption of an executive officer system | Yes |

| Voluntary advisory body to the Board of Directors | Nomination and Remuneration Advisory Committee |

| Accounting Auditor | Deloitte Touche Tohmatsu LLC |

Main agenda of the Board of Directors

| Category | Main agenda items |

|---|---|

| Management |

|

| Sustainability |

|

| Board of Directors/Officers |

|

| Stocks/Shareholders’ Meeting/Investors |

|

Rationale for Selection of Independent Outside Directors

| Name | Independent officer | Reason for appointment | Activity status |

|---|---|---|---|

| Takahiro Ikeda | ○ | Mr. Takahiro Ikeda was appointed as an outside director and member of the board based on his extensive experience as a director at a major chemical manufacturer, where he was involved in management of the company and a corporate group company. He is expected to use his broad understanding of management to continue providing an objective perspective and applicable advice for the Group’s domestic and overseas business development and risk management and to fulfill a supervisory function as part of the Board of Directors. Mr. Ikeda was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. His former company, Mitsubishi Chemical Corporation, sells Company products, but he has not been involved in the execution of the company’s business since retiring as company advisor in March 2016. In addition, business transactions between the companies account for less than 0.1% of either company’s consolidated sales, and Mitsubishi Chemical Corporation is not a specified associated service provider of the Company. |

Board of Directors meeting attendance: 18 of 18 meetings Nomination and Remuneration Advisory Committee meeting attendance: 11 of 11 meetings |

| Akio Sakumiya | ○ | Mr. Akio Sakumiya was appointed as an outside director and member of the board based on his extensive experience and deep insight to corporate governance as an executive vice president of a major electrical equipment manufacturer, where he was involved in management of the company and corporate group companies and served as a member and vice-chairman of various advisory committees related to personnel and remuneration for directors of the company. He is expected to use his broad understanding of management to continue providing an objective perspective and applicable advice for Group management strategy and corporate governance and to fulfill a supervisory function as part of the Board of Directors. Mr. Sakumiya was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. |

Board of Directors meeting attendance: 18 of 18 meetings Nomination and Remuneration Advisory Committee meeting attendance: 11 of 11 meetings |

| Yoshitaka Mitsuda | ○ | Mr. Yoshitaka Mitsuda was appointed as an outside director and member of the board based on his academic background in materials and extensive experience in university management and public-private-academic partnerships. He is expected to use his broad understanding of management to continue providing an objective perspective and applicable advice for the Group in the areas of research and development and sustainability and to fulfill a supervisory function as part of the Board of Directors. Mr. Mitsuda was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. |

Board of Directors meeting attendance: 18 of 18 meetings (post appointment) Nomination and Remuneration Advisory Committee meeting attendance: 11 of 11 meetings (post appointment) |

| Ryoko Nagata | ○ | Ms. Ryoko Nagata was appointed as an outside director and member of the board based on her extensive experience as an executive officer and auditor of a major food manufacturer, where she was involved in management of the company and corporate group companies. She is expected to use her broad understanding of management to provide an objective perspective and applicable advice for the Group in the areas of management strategy, sales, marketing, legal, and governance and to fulfill a supervisory function as part of the Board of Directors. Ms. Nagata was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. |

Board of Directors meeting attendance: 18 of 18 meetings (post appointment) Nomination and Remuneration Advisory Committee meeting attendance: 11 of 11 meetings (post appointment) |

| Makiko Akabane | ○ | Ms. Makiko Akabane was appointed as an outside director and member of the Board based on her extensive knowledge and experience consulting and providing support related to sustainability to multiple companies, the Ministry of the Environment, universities, and other organizations. She is expected to provide an objective perspective and applicable advice for the Group in the areas of sustainability and overseas business and to fulfill a supervisory function as part of the Board of Directors. Ms. Akabane was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. |

Board of Directors meeting attendance: 18 of 18 meetings (post appointment) Nomination and Remuneration Advisory Committee meeting attendance: 11 of 11 meetings (post appointment) |

Message from the Chairman of the Board of Directors

As a company with an Audit and Supervisory Board system, we believe it is essential to strengthen both the decision-making and oversight functions of the Board of Directors. Guided by this principle, we have actively worked to enhance Board effectiveness and have continuously improved its operations.

Our Board comprises members with diverse backgrounds and expertise, selected based on a skills matrix. In fiscal 2024, we supervised the progress of the Fourth Medium-term Management Plan aimed at realizing "UACJ VISION 2030," while deliberating on investments in designated priority areas. From a unique position as a Non-executive Internal Director, I serve as a bridge between internal and external members, integrating their diverse expertise to maximize Board effectiveness. We also leverage off-site meetings to engage in repeated discussions on critical management issues and the strategic direction that the Company should pursue.

As Chairman of the Board, I will continue to lead initiatives to enhance Board effectiveness and contribute to the medium- to long-term enhancement of corporate value.

Miyuki Ishihara Chairman of the Board

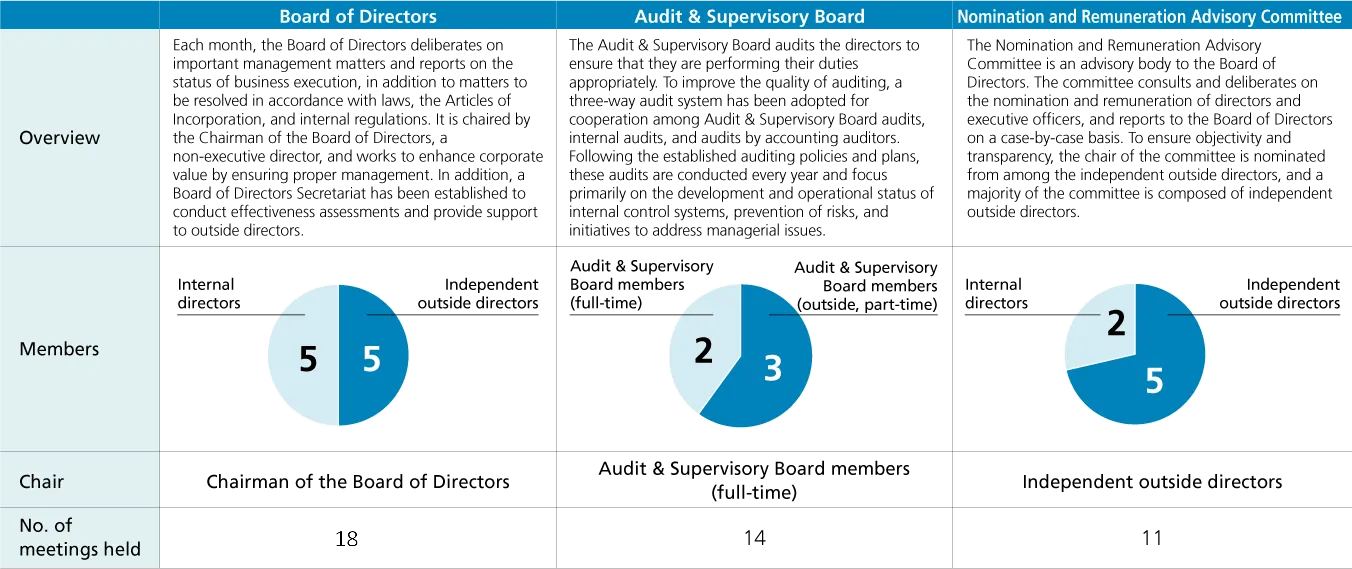

Audit & Supervisory Board

As an independent body that plays a role in corporate governance, the Audit & Supervisory Board is tasked with auditing the execution of duties by the board members. To improve the quality of auditing, a three-way audit system has been adopted for cooperation among Audit & Supervisory Board audits, internal audits, and audits by accounting auditors. Following the auditing policies and plans set out by the Audit &Supervisory Board and according to its regulation, these audits are conducted, in principle, once a year and focus primarily on the execution of duties by the board members in areas including the development and operation of internal control systems, prevention of risks, and initiatives to address managerial issues.

The Audit & Supervisory Board consists of five Audit & Supervisory Board members (including three independent outside members), two of which have knowledge of finance and accounting.

Rationale for Selection of Independent Outside Members of the Audit & Supervisory Board

| Name | Independent officer | Reason for appointment | Activity status |

|---|---|---|---|

| Hiroyuki Yamasaki | ○ | Mr. Hiroyuki Yamasaki was appointed as an independent Audit and Supervisory Board member to contribute from his extensive experience in finance and accounting as a certified public accountant specializing in corporate accounting and his advanced accounting expertise cultivated during his career to ensure appropriate audits and provide applicable advice to the Group. Mr. Yamasaki was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. |

Board of Directors meeting attendance: 18 of 18 meetings Nomination and Remuneration Advisory Committee meeting attendance: 14 of 14 meetings |

| Yoshiro Motoyama | ○ | Mr. Yoshiro Motoyama was appointed as an independent member of the Audit & Supervisory Board to contribute from his extensive experience as an executive vice-president of a major automobile manufacturer and from his broad perspective on management cultivated during his career to ensure appropriate audits and provide applicable advice to the Group Mr. Motoyama was appointed as an independent officer after being deemed to have no conflict of interest with the Company’s ordinary shareholders. |

Board of Directors meeting attendance: 18 of 18 meetings Nomination and Remuneration Advisory Committee meeting attendance: 14 of 14 meetings |

| Yuko Furumoto | ○ | Ms. Yuko Furumoto has successively held key positions at the compliance department of a major general trading company and possesses extensive global experience and deep insight in corporate legal affairs and compliance. We believe that she will leverage her advanced legal expertise as acquired throughout her career to appropriately conduct audits of our Group and offer valuable opinions, and we have therefore appointed her as an Outside Audit & Supervisory Board Member. We have determined that there is no risk of conflict of interest with general shareholders and have designated her as an Independent Director. | (Newly appointed) |

Nomination and Remuneration Advisory Committee

In order to strengthen corporate governance, the Company has established the Nomination and Remuneration Advisory Committee as an advisory body to the Board of Directors to enhance objectivity and transparency in the decision-making process for nominating directors, executive officers and auditors, as well as in determining the remuneration of directors and executive officers.

The committee places high priority on independence, with an independent outside director serving as the committee chair and five of the seven committee members being independent outside directors.

In fiscal 2024, we primarily deliberated on items including "initiatives for building an Outside Director talent pool," "mutual evaluation of Outside Directors," "successor candidate planning," and "revision of the executive compensation system," and we submitted formal recommendations to the Board of Directors on each occasion.

Main agenda items

- Initiatives for building an outside director talent pool

- Peer evaluation of outside directors

- Standards for the non-reappointment of Directors (clarification and application)

- Appointment of Audit & Supervisory Board memnbers

- Succession planning

- Confirmation of guidelines on exercising voting rights for institutional investors, etc.

- Targets and results for short-term performance-based compensation and medium- to long-term stock-based compensation

- Revision of the Director compensation system, etc.

Overview of Main Meeting Bodies

Improving the skills of directors and Audit & Supervisory Board members

UACJ’s policy is to ensure that directors and Audit & Supervisory Board members are fully equipped to perform their duties by providing the following training at the time of their appointment and during their term of office.

Upon appointment, we provide Directors and Audit & Supervisory Board Members with opportunities to deepen their understanding of their roles and responsibilities, as well as our business, financial condition, organizational structure, and other matters. For Outside Directors, this includes on-site visits to domestic and overseas business sites and Group companies. Training is also provided throughout the terms of appointment through opportunities for deepening understanding of governance, discussions of Group issues, and training opportunities appropriate for the knowledge, experience, and abilities of each individual director and corporate auditor.

In fiscal 2023, outside officers visited domestic and overseas business sites and group companies to deepen their understanding of the company’s business. In fiscal 2024, outside officers will participate in specific training on governance and compliance.

Support system for directors and Audit & Supervisory Board members

With the aim of enhancing discussions at the Board of Directors, we continue to provide support, such as presentations by external experts on governance, for each officer to deepen their awareness and understanding.

We also hold opinion exchange meetings between outside directors and outside Audit & Supervisory Board members which are separate from Board of Directors meetings, make efforts to actively incorporate the opinions of outside directors into business execution, convene meetings for only the outside officers, and support cooperation between outside directors and outside Audit & Supervisory Board members. Outside officers are provided materials in advance of Board of Directors meetings and opportunities are provided as necessary for outside officers to receive advance explanations of important matters and to meet with key working groups of internal officers.

Evaluation of the effectiveness of the Board of Directors

Each year, the Company evaluates and takes steps to improve the effectiveness of the Board of Directors. At appropriate intervals, we also engage third-parties to conduct analysis and evaluations with the intention of ensuring the neutrality and objectivity of our evaluations and to make our improvement measures even more effective.

Workflow of effectiveness evaluations

- From the perspective of ongoing follow-up, a survey is created based on the questionnaire used in the fiscal 2023 third-party evaluation.

- Directors and Audit & Supervisory Board Members submit written responses, and the Secretariat analyzes the results.

- The Board of Directors deliberates on the analysis and measures to improve effectiveness.

Main evaluation items

- Roles and responsibilities of the Board of Directors

- Decision making by the Board of Directors

- Supervisory functions of the Board of Directors

- Composition of the Board of Directors

- Operation of the Board of Directors

- Role of the Nomination and Remuneration Advisory Committee

- Relations with investors and shareholders

- Officer self-evaluations

Results of evaluation in fiscal 2024

- The scope and composition of internal and external members of the Board of Directors is appropriate

- Operation of the Board of Directors is appropriate with regard to the frequency of meetings and the deliberation time, content, and number of discussions

- Operation of the Board of Directors is appropriate with regard to the frequency of meetings and the deliberation time, content, and number of discussions

- The Nomination and Remuneration Advisory Committee’s reporting to the Board of Directors is conducted via a fair and appropriate process

- Regarding the issue from fiscal 2023 of continuously deepening discussions on key medium- to long-term challenges, appropriate initiatives were implemented, including the use of off-site meetings.

Future issues and measures

- Continuing off-site meetings to further enhance the quality of discussions on key challenges

- Advancing initiatives such as improving materials from the viewpoint of efficient operation

History of improvements to the effectiveness of the Board of Directors

| FY | Major items for improvement | Initiatives implemented in response to evaluations received |

|---|---|---|

| 2020 |

|

|

| 2021 |

|

|

| 2022 |

|

|

| 2023 |

|

|

| 2024 |

|

|

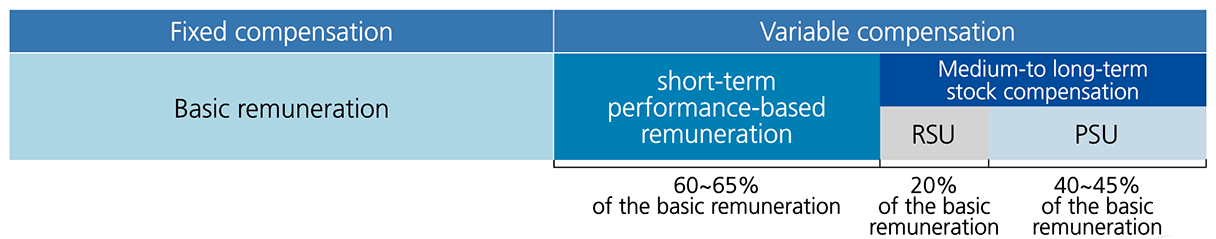

Remuneration of officers

UACJ’s officer remuneration system is intended to provide management incentive to respond to the expectations of a variety of stakeholders and to promote steady and sound business development to continue generating the profits needed to contribute to society. The system is also designed to share the benefits and risks of stock price fluctuations with shareholders and increase our officers' desire to help increase share prices, raise corporate value, and improve our performance in the medium and long term. The remuneration system is periodically reviewed to ensure it is functioning appropriately and effectively. Starting in fiscal 2025, we implemented a revision of the compensation system to further enhance motivation and incentives for contributing to performance improvement. The Nomination and Remuneration Advisory Committee annually reviews the remuneration system and assesses the need for revisions based on changes in the business environment and how the system is actually operating.

Resolutions regarding the remuneration of directors and Audit & Supervisory Board members were passed as described below at the 5th Annual General Meeting of Shareholders on June 21, 2018, the 8th Annual General Meeting of Shareholders on June 22, 2021, the 10th Annual General Meeting of Shareholders on June 21, 2023, the 11th Annual General Meeting of Shareholders on June 19, 2024, and the 12th Annual General Meeting of Shareholders on June 20, 2025.

- Basic remuneration and short-term performance-linked remuneration shall be limited to a total of ¥900 million per year for all Board of Directors members combined. (This amount excludes amounts paid as employee salaries. Remuneration for outside directors is limited to basic remuneration only and will not exceed a total of ¥150 million per year, included in the amount above, for all outside directors.)

- Medium- to long-term stock compensation for directors excluding outside directors shall be composed of a restricted stock units (RSU) plan and performance share units (PSU) plan. The RSU plan is applicable to directors other than outside directors, and the PSU plans is applicable to directors other than non-executive directors. The total amount of monetary remuneration claims and cash to be paid shall be within the amount calculated by multiplying the number of shares to be delivered by the market price of the stock at the time of delivery and the number of years of the applicable medium-term management plan period up to 60,000 shares per fiscal year for the RSU plan (of which 30,000 shares shall be delivered) and 200,000 shares per fiscal year for the PSU plan (of which 100,000 shares shall be delivered).

- Total remuneration for all Audit & Supervisory Board members shall not exceed ¥150 million per year.

a. Approach to officer remuneration

- A remuneration system that adds motivations towards achieving the performance targets (short-term and medium- to long-term) based on the Company’s business strategy;

- a remuneration level that is competitive enough to attract talented human resources who can lead the Company’s growth and to enhance their motivation to contribute to the Company;

- a remuneration system that involves a highly objective and transparent decision-making process; and

- a remuneration system that can contribute to the sharing of common interests with shareholders and leads to an increased shareholder value.

b. Remuneration system

- The officer remuneration for the Company’s Directors comprises of basic remuneration in the form of fixed remuneration, short-term performance-linked remuneration tied to the level of achievement of the Company’s performance in a single fiscal term, and medium- to long-term stock compensation that is tied to the level of achievement of the Company’s medium- to long-term performance. The remuneration for Outside Directors consists solely of the basic remuneration, as the main responsibility of Outside Directors is the supervision from an objective and independent perspective.

- Basic remuneration for each officer position is set by referring to remuneration survey data provided by an outside institution specialized in the gathering of this kind of data. Remuneration levels are determined based on comparisons to companies that are in similar industries and are of similar size to the Company.

- For each eligible Director, the standard amount of short-term performance-linked remuneration (in cases where the payment rate is 100%; the same applies below) is set at roughly 60% to 65% of his/her basic remuneration.

- For each eligible Director, the standard amount of medium-to long-term performance-linked remuneration is set at approximately 60% to 65% of his/her basic remuneration.

c. Mechanism for Variable compensation

Short-term performance-linked remuneration system

| Evaluation factors | Company-wide performance | Consolidated net income, Consolidated operating profit, consolidated ROE, consolidated ROIC. |

|---|---|---|

| Divisional performance | Divisional operating income, Segment operating profit, divisional ROIC. | |

| Sustainability | Evaluation of the level to which activity targets in the six materiality issues set out in our long-term management vision were achieved (weighting is approximately 10% of total short-term performance-linked remuneration) | |

| Individual performance | Mainly qualitative evaluation of important initiatives, etc., not reflected in company-wide, divisional performance and Sustainability evaluation for a single fiscal year (weighting is approximately 10% of total short-term performance-linked remuneration)) | |

| Evaluation period | Single fiscal year | |

| Range of variation in performance-linked remuneration | Changes within a range of 0 to 200% in accordance with the level of achievement, based on a payment ratio of 100% for 100% achievement of the goal | |

| Content of remuneration | Paid in cash | |

Medium- to long-term stock compensation system

Restricted stock units (a system of providing shares and cash payments conditional on continuing service for three further years)

| Evaluation factors | Conditional on continuing service |

|---|---|

| Evaluation timing | Three fiscal years |

| Range of variation in performance-linked remuneration | No change due to performance |

| Content of remuneration | Half of the assigned units with vested rights are provided as shares, with the remainder paid in cash |

Performance share units (a system of providing shares and cash payments in accordance with the level of achievement of medium- and long-term performance goals for the entire Company)

| Evaluation factors | Company-wide performance | Consolidated ROIC, consolidated adjusted EBITDA, consolidated D/E ratio |

|---|---|---|

| Total shareholder return | Evaluation based on the growth rate of the Company's total shareholder return divided by the growth rate of the TOPIX Index during the evaluation period | |

| Evaluation period | Period of the mid-term management plan | |

| Range of variation in performance-linked remuneration | Varies within a range of 0 to 200% in accordance with the level of achievement, based on a payment ratio of 100% for 100% achievement of the goal | |

| Content of remuneration | Half of the assigned units with vested rights are provided as shares, with the remainder paid in cash | |

d. Process for determining remuneration

- The policies and specific contents of the Company’s officer remuneration are deliberated at the Nomination and Remuneration Advisory Committee and determined by the Board of Directors referring to the Committee’s report. Over half of the Nomination and Remuneration Advisory Committee is comprised of Independent Outside Directors and Independent Outside Audit & Supervisory Board Members. Furthermore, advice from external specialists is sought as necessary to provide sufficient information to its members.

- Regarding short-term performance-based remuneration for Directors, the Nomination and Remuneration Advisory Committee confirms, at the beginning of the evaluation period, the targets for: 1) the portion based on the company-wide performance evaluation; 2) the portion based on the divisional performance evaluation; and 3) the portion based on the sustainability evaluation, and, at the end of the evaluation period, the level of achievement of these goals and the amount of payment according to the level of achievement. The Committee also confirms the appropriateness of the portion based on the individual performance evaluation. For medium- to long-term stock compensation, the Nomination and Remuneration Advisory Committee confirms the targets at the beginning of the evaluation period, as well as the level of achievement and the amount of remuneration based on the achievement level at the end of the evaluation period.

- The Board of Directors has delegated, to Mr. Miyuki Ishihara, the Representative Director & President, the decision on the individual evaluation for the short-term performance-linked remuneration on the basis of the amount of basic remuneration for each Director and the performance of divisions supervised by respective Directors excluding Outside Directors. The reason for the delegation is that the Representative Director & President is considered competent to evaluate respective directors’ significant efforts that are not reflected in the company-wide or divisional performance, taking into consideration the performance of the Company as a whole. The appropriateness of the decisions made on the delegated matters is reviewed in advance by the Nomination and Remuneration Advisory Committee.

- The amount of remuneration for Audit & Supervisory Board Members is determined by consultation among the Audit & Supervisory Board Members within the range approved by the general meeting of shareholders.

(For your reference)

[Shareholding Guidelines]

The Company recommends its Directors (excluding Outside Directors) and Executive Officers to own the Company’s shares with the value equal to approximately 50% of their basic remuneration (annual amount) within five years from the date of appointment as an officer.

Initiatives to date

| 2018 | Reviewed the remuneration system and implemented short-term performance-linked remuneration*1 and medium- to long-term stock compensation (PSU: Performance Share Unit) |

|---|---|

| 2020 | As the Company worked towards structural reform, increased the short-term performance-linked remuneration ratio, and introduced total shareholder return to the system of medium- to long-term stock compensation |

| 2021 |

|

| 2023 | Revised the maximum amount of remuneration for outside directors, taking into consideration the increase in the ratio of outside directors and the increased roles and responsibilities expected of outside directors |

| 2024 | Reorganized the remuneration system for non-executive directors in accordance with the new officer structure, revised the medium- to long-term stock compensation system for the fourth mid-term management plan |

| 2025 | In addition to raising the level of base compensation, we will increase the ratio of short-term performance-based compensation and medium- to long-term stock-based compensation to base compensation, thereby increasing the proportion that such account for in total compensation. |

- Outside directors are not subject to the Variable compensation system, as their primary duty is to provide supervision from an independent, objective standpoint.

Total remuneration of directors and Audit & Supervisory Board members in fiscal 2024

| Positions | Number of members | Total amount by type of remuneration | Total remuneration | ||

|---|---|---|---|---|---|

| Base salary | Short-term performance-linked remuneration | Medium- to long-term performance-linked remuneration | |||

| All directors (Outside directors) |

13 (5) |

¥340 million (¥72 million) |

¥85 million (–) |

¥56 million (–) |

¥445 million (¥72 million) |

| All Audit & Supervisory Board members (Outside members) |

3 (3) |

¥82 million (¥31 million) |

― (―) |

― (―) |

¥82 million (¥31 million) |

| Total (Outside directors and Audit & Supervisory Board members) |

19 (8) |

¥386 million (¥103 million) |

¥85 million (–) |

¥56 million (–) |

¥526 million (¥103 million) |

- Note1 The above table includes one Director whose term expired at the conclusion of the 9th fiscal term Ordinary General Meeting of Shareholders held on June 22, 2022, two Directors whose term expired at the conclusion of the 10th fiscal term Ordinary General Meeting of Shareholders held on June 21, 2023, and one Audit & Supervisory Board Member whose term expired at the conclusion of the 11th fiscal term Ordinary General Meeting of Shareholders held on June 19, 2024.

- Note2 For variable compensation, the amount to be recognized as an expense in the current fiscal year is stated.

Succession plans

UACJ has put in place succession plans for its president and officers. Every year, the president selects a pool of candidates and confirms measures for their development and other details. Various human resource data is used to identify successor candidates, and an internal process is set up to identify talent from multiple perspectives. In order to provide them with the abilities and experience necessary for senior management, the strengths and issues of each pool member are identified, and they are developed through tough assignments and transfers. The Nomination and Remuneration Advisory Committee then confirms the content and works to ensure the suitability of the succession plans.

The progress of succession planning is regularly reported to the Board of Directors to ensure objectivity.

The committee also led the evaluation of the final candidates for the new president and determined that Mr. Tanaka was the most suitable for the position, with the Board of Directors resolving at its January 30, 2024 meeting to appoint him.

Workflow of the succession plan for the Company president

Creation

A company-wide management human resources development review committee (consisting of the Company president, members of each business division, and the officer in charge of human resources) carries out the following:

- Checks officer candidates and shares information about their associated training issues and organizational management training plan

- Checks and amends the above content from a cross-divisional, company-wide viewpoint

Assessment

The Company president carries out the following:

- Decides on candidates for the presidential succession based on the discussions of the company-wide management human resources development review committee

- Evaluates the above personnel, and after identifying strengths and areas for development, reviews methods of training (including difficult assignments and transfers)

- Reports the proposed candidate list based on the results of this assessment to the Nomination and Remuneration Advisory Committee

Checking and optimization

The Nomination and Remuneration Advisory Committee carries out the following:

- Checks personnel selection and development issues and measures for president successor candidates, checks personnel selection and development measures for the executive successor pool personnel, and checks and discusses whether internal processes and initiatives including these are appropriate

- Supervises training (monitoring)

- Reports president/officer candidate numbers and the status of training to the Board of Directors

- Observes successor candidates

The Board of Directors:

- Reviews the report of the Nomination and Remuneration Advisory Committee and oversees (monitors) development efforts and progress

Selection and nomination of officers

The Nomination and Remuneration Advisory Committee deliberates and decides on the nomination of directors and other senior management by evaluating candidates based on elements such as their career history and capabilities. The Board of Directors makes the final decision on officer appointments based on the committee’s recommendations. Candidates for the Audit & Supervisory Board must also be approved by the Audit & Supervisory Board. When selecting independent outside directors, the Company considers candidates based on its criteria for independence, and seeks individuals who can be expected to contribute to the Company through frank, active, and constructive dialogue at the Board of Directors meetings. Opportunities are provided to evaluate their contributions after appointment. Currently two of the five independent outside directors are women, and four of the directors have experience in corporate management. UACJ will continue its focus on achieving a balance in the overall knowledge, experience, and abilities of the Board of Directors, and in developing systems that take into account diversity and scale.

Peer evaluation of outside directors

In recognition of the fact that outside directors, who are responsible for management oversight, should be evaluated independently to ensure that they are fulfilling their expected roles and responsibilities appropriately, UACJ has implemented mutual evaluations of outside directors.

In the peer evaluations, each outside director (self-evaluation) and committee member (peer evaluation) responds to a questionnaire prepared by the Nomination and Remuneration Advisory Committee. In addition, directors on the executive side are also asked to complete a questionnaire, thereby ensuring that the evaluation is multifaceted.

The results of the evaluations are reported to the Nomination and Remuneration Advisory Committee, which confirms that each outside director is fulfilling their roles and responsibilities appropriately, and are also used in the process for reappointment or non-reappointment.

Peer evaluations can be conducted only when there is a healthy tension based on mutual trust through discussions at meetings of the Board of Directors and the Nomination and Remuneration Advisory Committee, and they function effectively as an opportunity for reflection on the roles and responsibilities of outside directors.

Skill matrix

The Nomination and Remuneration Advisory Committee and the Board of Directors have discussed and established the following skills (knowledge, experience, and abilities) that a member of the Board of Directors should possess in order for the Company to achieve the long-term management vision UACJ VISION 2030 as well as to realize the growth, value creation and corporate structure required to reach UACJ VISION 2030.

We intend to create a Board of Directors that is overall equipped with nine skill sets for executing effective management oversight. The following table shows these skills.

Reason for selection as a desired skill field

| Skill fields | Reasons for appointment | |

|---|---|---|

| ⅰ | Corporate management/Strategy | Knowledge, experience, and abilities related to a wide range of corporate management and strategies, whether at UACJ or elsewhere, are essential for our Group, which aims to maximize earnings and improve profitability by expanding value creation and working with various stakeholders to address priority issues concerning the business environment. |

| ⅱ | Finance/ Accounting | Strengthening the Group’s financial base through management initiatives that emphasize capital efficiency is a priority issue for us, and knowledge, experience, and abilities in finance and accounting are essential for the preparation, supervision, and auditing of proper financial statements. |

| ⅲ | Sales/Marketing | Knowledge, experience, and abilities in sales and marketing are essential to identify demand in growing fields and markets and to expand the areas of activity for aluminum as a material with environmental value. |

| ⅳ | Overseas business | Knowledge, experience, and abilities relating to overseas business are essential for expanding the scope of aluminum’s application by taking advantage of our three-country supply network spanning Japan, North America, and Thailand, and for helping to stabilize supply chains in particular countries, industries, and other sectors. |

| ⅴ | R&D/Manufacturing | In addition to helping to reduce the environmental impact of aluminum products, knowledge, experience, and abilities in R&D and manufacturing are essential in strengthening the foundation that supports value creation and stable business operations. |

| ⅵ | Legal/Governance | Legal and governance knowledge, experience, and ability are indispensable to ensuring comprehensive compliance and risk management and to executing the corporate governance required of a listed company in the prime market and enhancing corporate value. |

| ⅶ | IT/Digital | Knowledge, experience, and abilities in IT and digital are essential for creating and expanding new business domains that contribute to fulfilling the UACJ Vision 2030 and for strengthening the foundation that supports stable business operations. |

| ⅷ | Sustainability | In order to contribute to the “realization of a brighter world,” knowledge, experience, and abilities relating to sustainability are essential to drive the construction of a “recycling-based society for aluminum,” to utilize and develop the diverse human resources that support our business, and to promote diversity. |

| ⅸ | Other industries/fields | Knowledge, experience and ability in other fields and industries is indispensable to fulfilling the UACJ Vision 2030 and to providing an outside perspective to supervising management and diversity to the Board of Directors. |

Board composition and expertise

Directors

Audit & Supervisory Board members

| Name (birthdate) |

Position | Gender | Nomination and Remuneration Advisory Committee | Major areas of professional experience/areas where particular contributions are expected | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management and strategy | Finance and accounting | Sales and marketing | Overseas business | R&D and manufacturing | Legal and governance | IT and digital | Sustainability | Other industries/fields | Commissioned and responsible duties | ||||

| Miyuki Ishihara (July, 1957) |

Directors |

male |

○ | ○ | ○ | ○ | ○ | ||||||

| Shinji Tanaka (January, 1963) |

Representative Director |

male |

○ | ○ | ○ | ○ | General management | ||||||

| Joji Kumamoto (April, 1962) |

Directors |

male |

○ | ○ | ○ | ○ | Commissioned as head of the Corporate Strategy Division | ||||||

| Fumiharu Jito (July, 1963) |

Directors |

male |

○ | ○ | ○ | General Manager of the Marketing & Technology Division Commissioned as the Director of the R&D Center, Marketing & Technology Division Commissioned with DX promotion |

|||||||

| Kozo Okada (April, 1967) |

Directors |

male |

○ | ○ | ○ | ○ | Commissioned as General Manager of the Finance and Accounting Division | ||||||

| Takahiro Ikeda (July, 1951) |

Outside Directors |

male |

○ | ○ | ○ | ○ | ○ | ||||||

| Akio Sakumiya (September, 1952) |

Outside Directors |

male |

○ | ○ | ○ | ○ | |||||||

| Yoshitaka Mitsuda (November, 1959) |

Outside Directors |

male |

○ | ○ | ○ | ○ | |||||||

| Ryoko Nagata (July, 1963) |

Outside Directors |

female |

○ | ○ | ○ | ○ | ○ | ||||||

| Makiko Akabane (November, 1969) |

Outside Directors |

female |

○ | ○ | ○ | ○ | |||||||

| Ryu Sawachi (April, 1961) |

Audit & Supervisory Board members |

male |

○ | ○ | |||||||||

| Haruhiro Iida (March, 1964) |

Audit & Supervisory Board members |

male |

|||||||||||

| Hiroyuki Yamasaki (September, 1954) |

Outside Audit & Supervisory Board members |

male |

○ | ○ | ○ | ○ | |||||||

| Yoshiro Motoyama (March, 1956) |

Outside Audit & Supervisory Board members |

male |

○ | ○ | ○ | ||||||||

| Yuko Furumoto (October, 1963) |

Outside Audit & Supervisory Board members |

female |

○ | ○ | |||||||||

- Note: A circle is placed in the fields where particular contributions are expected based on each director and auditor's "knowledge," "experience," and "ability," but this does not represent all the "knowledge," "experience," and "ability" possessed by each officer.

Internal control

The UACJ Group endeavors to strengthen its internal control system to help ensure that its business activities are in line with management objectives, within the law and rational. Furthermore, as regards the status of internal controls stipulated by the Financial Instruments and Exchange Act, the Internal Auditing Department conducts tests and assessments with the aim of ensuring the reliability of financial reporting.

Status of the Internal Control System

As described below, the UACJ Group’s internal control systems (Systems for ensuring that the execution of duties by the Directors and employees of the Company and the Group complies with laws and ordinances, and the Articles of Incorporation, and for ensuring the propriety of the business activities of the corporation and of the corporate group consisting of the corporation and its subsidiaries) have been established in accordance with Japan’s Companies Act and Ordinance for Enforcement of the Companies Act.

a. Systems for ensuring execution of duties by Directors and employees of the Company and the Group is in compliance with the laws and regulations and the Articles of Incorporation

- The Company and its Group aim to be a corporate group that acts in accordance with the management philosophy and action guidelines and complies with laws and regulations and the Articles of Incorporation.

- Employee training is provided mainly by the CSR Committee by holding seminars and distributing manuals. Moreover, compliance activities are promoted by taking such measures as detecting regulatory violations.

- An internal reporting system has been put in place for early detection and correction of compliance violations.

- The Internal Auditing Department acts as the Company’s internal audit unit. It monitors the performance of duties in individual business units, audits the effectiveness of internal control system, and reports findings to the Board of Directors.

b. Systems for the retention and management of information on the execution of duties by Directors

- Information on the execution of duties by Directors, including Board meeting minutes and approval documents, is prepared and retained in accordance with internal rules.

- Directors and Audit & Supervisory Board Members can access necessary information whenever they need.

c. Provisions and other systems concerning the management of the risk of loss for the Company and its Group

- The Company and its Group properly address, in accordance with internal rules, environmental, safety, health, quality, information security, export management, and other risks shared by the Company and its Group as a whole. Risks specific to particular business units are managed by the units and reported to the CSR Committee for cross-sectional risk management.

d. Systems for ensuring efficient execution of duties by Directors of the Company and its Group

- The Company and its Group ensure that effective execution of duties is carried out by such means as establishing a division of duties in accordance with internal rules.

- Individual business units are responsible for setting specific targets for the mid-term management plans and single fiscal year budgets prepared by the Company and managing their achievement.

e. Systems for ensuring the propriety of operations by the subject corporation and the corporate group consisting of it and its parent company and/or subsidiaries

- The UACJ Group establishes and puts in place an internal control system.

- The Internal Auditing Department conducts operational audits. The audit results are reported to the Audit & Supervisory Board Members and the Representative Director to ensure strict compliance by the UACJ Group as a whole. Furthermore, the Company’s affiliates are required to consult with the Company on important management issues according to their own internal rules. If required by circumstances, the Company will review its rules concerning the management of affiliates to ensure the propriety of business activities carried out by the Group.

f. Matters concerning employees to be assigned to assist the Audit & Supervisory Board Members at their request

- The Company appoints employees who are to assist the duties of the Audit & Supervisory Board Members under the instructions of the Members.

g. Matters concerning the independence of the employees referred to in the previous item from Directors and the issuance of effective instructions to the employees

- The employees referred to above are kept independent from the Directors’ instructions and supervision and their personnel affairs must be agreed on in advance by the Audit & Supervisory Board.

h. Systems enabling Directors and employees of the Company and its Group to make a report to the Audit & Supervisory Board Members and systems for other reports to the Audit & Supervisory Board Members

- When any of the following are found during the course of duties, Directors, Executive Officers, and employees of the Company and its Group must report them immediately to the Company’s Audit & Supervisory Board Members: any violations against laws and regulations or the Articles of Incorporation; fraudulent activities committed; or any facts that may cause serious damage to the Company or its Group.

- Directors, Executive Officers, and employees must make a report or resolution based on the Board of Directors Rules and other internal rules at the Board meetings or other meetings attended by the Audit & Supervisory Board Members.

- It is prohibited to give disadvantageous treatment to the Company’s or its Group’s Director, Executive Officer, or employee who made a report to the Company’s Audit & Supervisory Board Members for the reason that he/she made that report.

i. Other systems for ensuring that audits by the Audit & Supervisory Board Members can be performed effectively

- The Board of Directors must ensure the attendance of the Audit & Supervisory Board Members at important meetings including Board meetings and management meetings.

- Audit & Supervisory Board Members and the Representative Director must hold meetings regularly to exchange views.

- When a request is received from the Audit & Supervisory Board Members to ensure the effectiveness of their audits, Directors, Executive Officers, and heads of relevant units must respond in good faith.

- Expenses stipulated in Article 388 of the Companies Act shall be handled in accordance with rules.

Strategic shareholdings

We hold shares in companies that we deem necessary for the sustainable growth and smooth conduct of our business, including the maintenance and strengthening of transactions, business alliances, and the stable procurement of raw materials. In accordance with our basic policy of minimizing and reducing such holdings, each year the Board of Directors conducts a comprehensive review of individual cross-shareholdings, examining both quantitative and qualitative aspects such as their significance and economic rationale. Shareholdings that are, as a result of the examination, deemed to have little significance or rationale are to be sold off sequentially. As of the end of March 2024, UACJ held cross-shareholdings in 29 companies. The total amount of cross-shareholdings on the balance sheet at the end of fiscal 2024 was 5.934 billion yen, which represents 1.86% of total consolidated equity.

Anti-takeover measures

Presently, UACJ has not adopted any anti-takeover measures.