Actions toward a Decarbonized Society

- HOME

- Sustainability

- A Future where the Earth can Continue to be Beautiful and Bountiful

- Actions toward a Decarbonized Society

Our Approach

Addressing climate change has become an urgent issue that society as a whole must tackle. To fulfill this responsibility, we have positioned the realization of carbon neutrality—including the reduction of greenhouse gas (GHG) emissions—as one of our material issues. We will contribute to reducing GHG emissions across society and to building a sustainable society not only by reducing GHG emitted through our own business activities but also by expanding opportunities for the utilization of aluminum.

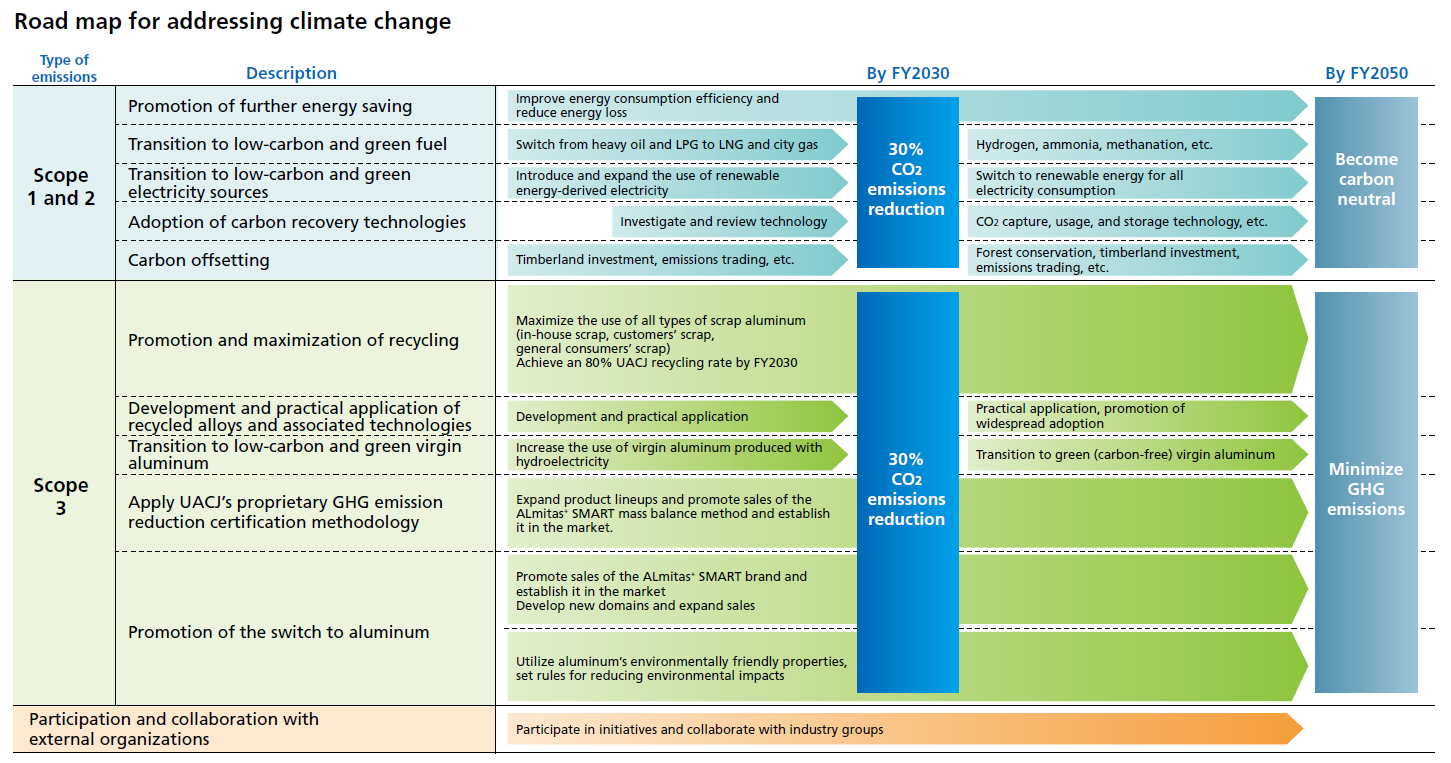

Roadmap for Addressing Climate Change

Participating in the GX League for Climate Action

In April 2024, we joined the GX League, a framework in which diverse enterprises and organizations aim for carbon neutrality. The GX League is the industry-academia-government collaboration structure for achieving the Japanese government’s target of a 46% GHG cut by fiscal 2030 (vs. fiscal 2013).

As a leading company representing Japan’s aluminum sector, we will lead decarbonization efforts within the industry. We are strengthening communication with the Japanese government, participating in cross-industry rule-making arenas, and pursuing business-opportunity expansion through the promotion of climate measures.

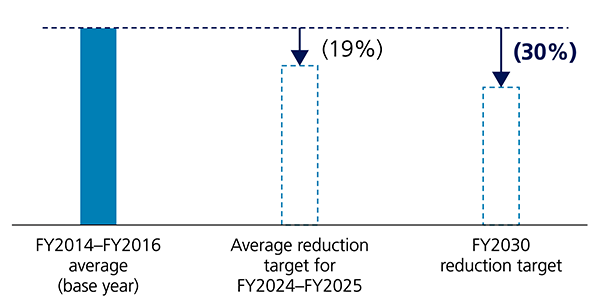

Our CO2 and GHG reduction targets in the GX League (Scope 1 & 2 total) are an average 19% cut for fiscal 2024–2025 and a 30% cut for fiscal 2030 (baseline: three-year average fiscal 2014–2016). This plan has received GX League Secretariat approval.

GX League Scope 1 and 2 GHG emissions reduction targets

Climate-related Disclosures (TCFD)

In September 2021, we declared our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and we joined the TCFD Consortium. We were also selected for the Ministry of the Environment’s "Fiscal 2021 TCFD-aligned Climate Risk & Opportunity Scenario Analysis Support Project," which promotes the integration of climate-related risks and opportunities into management strategy. Based on TCFD recommendations, we actively disclose the risks and opportunities that climate change poses to our business from the four perspectives of governance, strategy, risk management, and metrics & targets.

Key Initiatives

CO2Emissions Trends

The UACJ Group consumed a total of 5,210GWh of energy in fiscal 2024, an increase of 3.1% from fiscal 2023.

Group CO2 emissions were 521,000 t-CO2 for Scope 1 and 368,000 t-CO2 for Scope 2 (reference value: market standard), for a total of 889,000 t-CO2, approximately 21,000 t-CO2 more than in fiscal 2023.

Group CO2 emissions per unit production were 0.904t-CO2/product ton, an 5.3% decrease from fiscal 2023.

Location-based method Scope 2 emissions were 450,000 t-CO2.

The main reasons for the improvement in CO2 emissions per unit production are believed to be the increase in production volume in fiscal 2024, combined with the increased use of renewable energy electricity and various

improvement activities, which enabled a recovery in performance.

UACJ Group CO2 Emissions (Japan + overseas)

| Fiscal 2019 |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

Fiscal 2023 |

Fiscal 2024 |

||

|---|---|---|---|---|---|---|---|

| Fuel Scope 1 CO2 emissions (thousand tons CO2) |

ー | 514 | 493 | 557 | 528 | 501*3 | 521 |

| Electricity Scope 2 CO2 emissions (thousand tons CO2) |

Location-based | 492 | 446 | 479 | 480 | 447 | 450 |

| reference value: market standard*2 |

ー | ー | ー | ー | 367 | 368 | |

| Scope 1+2 CO2 emissions (thousand tons CO2) |

Location-based | 1,005 | 939 | 1,037 | 1,008 | 948 | 971 |

| reference value: market standard*2 |

ー | ー | ー | ー | 868*4 | 889 | |

| CO2 emissions per product ton*1 (t-CO2/product ton) |

Location-based | 1.118 | 1.109 | 0.999 | 0.998 | 1.038 | 0.982 |

| reference value: market standard*2 |

ー | ー | ー | ー | 0.955 | 0.904 |

- Companies and sites as of September 30, 2025

- Measurement scope:

(Japan) UACJ (Nagoya, Fukui, Fukaya, Nagoya(Extrusion), Oyama, Foundry & Forging), UACJ Extrusion Anjo Corporation, UACJ Extrusion Shiga Corporation, UACJ Extrusion Gunma Corporation, UACJ Foil Corporation (Shiga, Nogi, Isesaki), Nikkin Co., Ltd. (Saitama), UACJ Metal Components Corporation (Sendai, Narita, Ena, Shiga, Hiroshima, Koriyama), UACJ Aluminum Center Corporation (Utsunomiya Color Aluminum, Fukaya, Shiga, Nara), Izumi Metal Corporation, Kamakura Industry Co., Ltd., UACJ Marketing & Processing

(Overseas) UACJ (Thailand) Co., Ltd., UACJ Extrusion Czech s.r.o., UACJ Extrusion (Thailand) Co., Ltd., UACJ Foundry & Forging (Vietnam) Co., Ltd., UACJ Foil Malaysia Sdn. Bhd., UACJ Automotive Whitehall Industries, Inc.(6th Street、Madison、Progress Drive、Paducah、Flagstaff、Mexico), UACJ Metal Components Mexico, S.A. de C.V., UACJ Metal Components Central Mexico, S.A. de C.V., UACJ Metal Components (Thailand) Co., Ltd, P.T. Yan Jin Indonesia

- Measurement scope:

(Japan) UACJ (Nagoya, Fukui, Fukaya, Nagoya(Extrusion), Oyama, Foundry & Forging), UACJ Extrusion Anjo Corporation, UACJ Extrusion Shiga Corporation, UACJ Extrusion Gunma Corporation, UACJ Foil Corporation (Shiga, Nogi, Isesaki), UACJ Aluminum Center Corporation (Utsunomiya Color Aluminum)

(Overseas) UACJ (Thailand) Co., Ltd., UACJ Extrusion Czech s.r.o., UACJ Extrusion (Thailand) Co., Ltd., UACJ Foundry & Forging (Vietnam) Co., Ltd., UACJ Foil Malaysia Sdn. Bhd., UACJ Automotive Whitehall Industries, Inc.(6th Street、Madison、Progress Drive、Paducah、Flagstaff、Mexico) - Country emission factors are used for overseas business units when power company emission factors are not available.

- Due to an error in the city gas coefficient, the FY2023 Scope 1 results have been revised.

Before correction: 467; after correction: 501 - Due to an error in the city gas coefficient, the FY2023 Scope 1 results have been revised.

Before correction: 833; after correction: 868

UACJ CO2 Emissions (Parent only)

| Fiscal 2022 | Fiscal 2023 | Fiscal 2024 | ||

|---|---|---|---|---|

| Fuel Scope 1 CO2 emissions (t-CO2/yr.) |

ー | 338 | 328*5 | 346 |

| Electricity Scope 2 CO2 emissions (t-CO2/yr.) Location-based |

Location-based | 234 | 228 | 260 |

| reference value: market standard |

ー | 195 | 218 | |

| Scope 1+2 CO2 emissions (t-CO2/yr.) |

Location-based | 571 | 537 | 606 |

| reference value: market standard |

ー | 522*6 | 563 | |

| CO2 emissions per product ton (t-CO2/product ton) |

Location-based | 0.969 | 0.967 | 1.011 |

| reference value: market standard |

ー | 0.910 | 0.940 |

- Due to an error in the city gas coefficient, the FY2023 Scope 1 results have been revised.

Before correction: 309; after correction: 328 - Due to an error in the city gas coefficient, the FY2023 Scope 1 results have been revised.

Before correction: 504; after correction: 522

Fiscal 2024 UACJ Group CO2 Emissions (Scope 3 Japan + overseas)

| Components | Fiscal 2019 | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|---|---|---|

| Category 1: Purchased goods and services*7 | 5,424 | 5,260 | 6,123 | 5,313 | 4,524 | 5,079 |

| Category 2: Capital goods | 172 | 63 | 73 | 93 | 116 | 147 |

| Category 3: Fuel- and energy-related activities (not included in scope 1 or scope 2) | 167 | 145 | 160 | 132 | 143 | 144 |

| Category 4: Upstream transportation and distribution | 92 | 90 | 97 | 114 | 106 | 116 |

| Category 5: Waste generated in operations | ー | ー | ー | 0.4 | 0.4 | 0.4 |

| Category 6: Business travel | ー | ー | ー | 1 | 1 | 1 |

| Category 7: Employee commuting | ー | ー | ー | 2 | 2 | 2 |

| Category 12: End-of-life treatment of sold products | ー | ー | ー | ー | 0.1 | 0.1 |

| Total | 5,855 | 5,558 | 6,453 | 5,655 | 4,893 | 5,490 |

- Categories are classified based on the Scope 3 Standard and Basic Guidelines. Categories 8–11 and 13–15 are excluded from calculations due to their minimal impact.

- FY2019 results have not undergone third-party assurance.

- Scope of data collection

(Japan) UACJ (Nagoya(Flat Rolled), Fukui, Fukaya, Nagoya(Extrusion), Oyama, and Foundry & Forging); UACJ Extrusion Anjo; UACJ Extrusion Shiga; UACJ Extrusion Gunma; UACJ Foil (Shiga, Nogi, and Isesaki); and UACJ Aluminum Center (Utsunomiya Color Aluminum). (Overseas) UACJ (Thailand) Co., Ltd.

Main Initiatives in Production Processes

New Energy Saving Subcommittee

The UACJ Group Energy Saving Subcommittee meets regularly to promote energy-saving activities at business sites. Beginning in FY2022, we created the New Energy Saving Subcommittee with a revised member makeup and meeting schedule with the aim of stepping up our activities to reduce GHG emissions and promote energy conservation.

Examples of Energy-Saving Activities

The table below shows the main energy-saving activities implemented by the UACJ Group in fiscal 2023.

Group business sites are also implementing energy-saving measures, which include changing furnace heating systems, updating electrical equipment, and repairing steam and air leaks.

Examples of CO2 Emissions Reductions (New for fiscal 2024)

| Business Location | Theme | CO2 Emissions Reduction Impact (t-CO2/yr.) |

|---|---|---|

| Fukui Works | Improvement of heating furnace | 1,000 |

| Multiple business sites | Improvement of furnace combustion | 1,000 |

| Nagoya Works | Renewal of DX Gas Generator | 800 |

| Multiple manufacturing sites | Switching to LED Lighting | 700 |

| Fukui Works | Optimization of Melting Furnace Firing Patterns | 400 |

| Nagoya Works | Reduction in Air Consumption | 400 |

| Multiple business sites | Productivity Improvement (Scope 1) | 4,000 |

| Total | 3,700 |

Switching to LNG as a Heat Source for Production Processes

Using LNG as a heat source produces approximately 30% less CO2 emissions compared to LNG and heavy oil with the same calorific value.

As of the end of fiscal 2024, LNG (including city gas) accounted for approximately 90% of the fuel used at our three works on a calorific value basis.

Introduction of renewable energy-derived electricity

The UACJ Group is systematically introducing renewable energy-derived electricity to power its business sites. In fiscal 2024, we purchased approximately 246,000 kWh of renewable energy-derived electricity both in Japan and overseas through on-site PPAs, renewable energy electricity options, and non-fossil fuel certificates. This will reduce our CO2 emissions by approximately 104,000 t-CO2 per year*8. Of particular note, at our 20 domestic business sites*9, we have switched to 100% renewable energy-derived electricity and continue to maintain this status.

- The CO2 emission coefficient was calculated using the national average for fiscal 2023, which is 0.423kg-CO2/kWh.

- UACJ(Foundry & Forging), UACJ Extrusion Anjo Corporation, UACJ Extrusion Gunma Corporation, UACJ Extrusion Shiga Corporation, UACJ Metal Components Corporation (Sendai, Narita, Ena, Shiga, Hiroshima, Koriyama), UACJ Aluminum Center Corporation (Utsunomiya Color Aluminum, Shiga, Nara),UMP, Kamakura Industry Co., Ltd., Izumi Metal Corporation (Yamagata Logistics Center, Tochigi Logistics Center, Noda Logistics Center, and Kawasaki Logistics Center)

- Companies and sites as of September 30, 2025.

Main Initiatives in Logistics

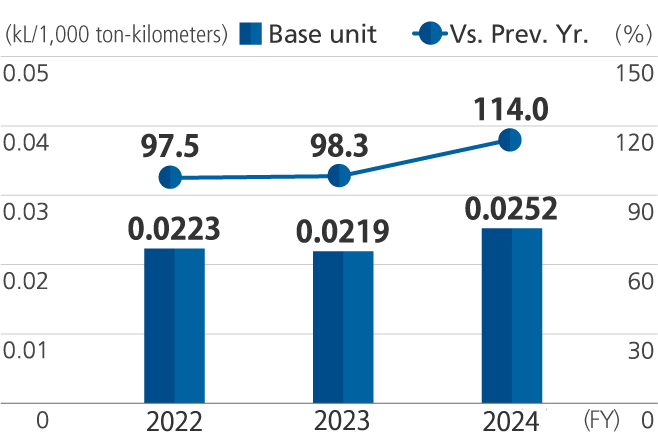

UACJ is taking steps to reduce the energy it uses in its logistics processes. As a “specified consignor”*10 as defined by the Energy Efficiency Act *11, UACJ is promoting activities with the aim of improving transport energy efficiency per ton-kilometer by an average of 1% annually over five years.

In fiscal 2024, transportation energy intensity per sales volume deteriorated 14.0% compared to fiscal 2023. The primary reason was the integration into UACJ of three sites—Nagoya Works, Oyama Works, and Foundry & Forging Works—characterized by relatively small-lot production and high transportation energy intensity.

- A specified consignor is a shipper that annually transports more than 30 million ton-kilometers of their own cargo

- Energy Efficiency Act: Also known as the Act on the Rational Use of Energy, the act calls for consignor companies, which place orders with freight transport firms, and others to form specific plans to conserve energy and to reduce energy consumption.

Amount of Energy Used for Shipping, per Unit of Sales

- Periodic report submitted values

Main Initiatives in Offices

Energy-Saving Activities in Offices

UACJ takes active steps to reduce energy consumption in its offices, including by controlling temperatures maintained by air conditioner systems following the Cool Biz and Super Cool Biz campaigns as strictly enforcing turning off of lights and electronic equipment when not in use.

The head office is promoting greater use of telework (work from home) and in January 2022 replaced individual desks with a free address system in its offices. Additionally, in July 2022, UACJ consolidated the head office functions of its affiliated companies in Otemachi, Tokyo as part of its efforts to further improve office space efficiency and to reduce energy consumption for air conditioning, lighting, and electronic equipment.

Office-Based Environmental Protection Measures

For office supplies, we are proactively sourcing items that comply with the Law Concerning the Promotion of Procurement of Eco-Friendly Goods and Services by the State and Other Entities and eco-mark items.

- 補足:既存開示項目以外に、新たに開示・掲載する項目の有無、及び掲載有の場合は素材情報をご教示ください。

External Recognition and Evaluation

Voluntary participation in the CDP

Voluntary participation in the international climate-action initiative CDP (Carbon Disclosure Project) yields objective evaluation of our greenhouse-gas management level while raising our activity standards. As an example, we calculate greenhouse-gas emissions per GHG Protocol definitions—Scope 1 (direct emissions from in-house fuel combustion), Scope 2 (indirect emissions from electricity used in-house), and Scope 3 (upstream and downstream emissions across the entire supply chain)—and we publish them this website.